UNIT AND BATCH COSTING

Table of content

1. INTRODUCTION

So far, we have discussed in earlier chapters, the element wise cost collection, calculation and its accounting under integral and non- integral accounting systems. Now we will discuss how the cost accounting information can be presented and used according the needs of the management. To fulfil the need of the users of the cost accounting information, different methods of costing are followed. Costing methods enable the users to have customized information of any cost object according to the need and suitability. Different methods of costing have been developed according to the needs and nature of industries. For the sake of simplicity, industries can be grouped into two basic types i.e. Industries doing job work and industries engaged in mass production of a single product or identical products.

For industry doing job work

An entity which is engaged in the execution of special orders, each order being distinguishable from each other, such a concern is thought of involved in performing job works. Jobs are worked strictly in accordance with the customer’s specifications and requirements, thus, each job order is unique. Examples of job order types of production are: ship building, construction of road and bridges, manufacturing of heavy electrical machineries and tools, wood and furniture works etc. Here, each job or unit of production is treated as a separate identity for the purpose of costing. The methods of costing for ascertaining cost of each job are known as a job costing, contract costing and batch costing.

For continuous or process type of industries

The continuous or process type of industries are characterised by the continuous production of uniform products according to the standard specifications. In such a case the successive lots are generally indistinguishable as to size and form and, even if there is some variation in specifications, it is of a minor character. Examples of continuous type of industries are chemical and pharmaceutical products, paper/food products, canning, paints and varnish oil, rubber, textile etc. Here the methods of costing used for the purpose of ascertaining costs are: process costing; single output costing; operating costing etc.

2. UNIT COSTING

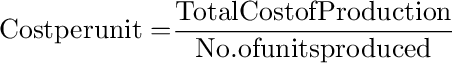

Unit costing is that method of costing where the output produced is identical and each unit of output requires identical cost. Unit costing is synonymously known as single or output costing, but these are sub-division of unit costing method. This method of costing is followed by industries which produce single output or few variants of a single output. Under this method costs, are collected and analysed element wise and then total cost per unit is ascertained by dividing the total cost with the number of units produced. If we have to state it in the form of a formula, then

This method of costing, therefore finds its application in industries like paper, cement, steel works, mining, breweries etc. These types of industries produce identical products and therefore have identical costs.

3. COST COLLECTION PROCEDURE IN UNIT COSTING

The cost for production of output is collected element wise and posted in the cost accounting system for cost ascertainment. The element-wise collection is done as below:

Collection of Materials Cost

Cost of materials issued for production are collected from Material Requisition notes and accumulated for a certain period or volume of activity. The cost of material so accumulated is posted in cost accounting system. Through the cost accounting system, cost sheet for the period or activity is prepared to know cost for the period element-wise and functions-wise.

Collection of Employees (labour) Cost

All direct employee (labour) cost is collected from job time cards or sheets and accumulated for a certain period or volume of activity. The time booked or recorded in the job time and idle time cards is valued at appropriate rates and entered in the cost accounting system. Other items of indirect employee (labour) costs are collected from the payrolls books for the purpose of posting against standing order or expenses code numbers in the overhead expenses ledger.

Collection of Overheads

Overheads are collected under suitable standing orders numbers, and selling and distribution overheads against cost accounts numbers. Total overhead expenses so collected are apportioned to service and production departments on some suitable basis. The expenses of service departments are finally transferred to production departments. The total overhead of production departments is then applied to products on some realistic basis, e.g. machine hour; labour hour; percentage of direct wages; percentage of direct materials; etc.

Treatment of spoiled and defective work

| Circumstances |

Treatment |

| Loss due to normal reasons |

When a normal rate of defectives has already been established and actual number of defectives is within normal limit, the cost of rectification or loss will be changed to the entire output. If, on the other hand, the number of defective units substantially exceed the normal limits, the cost of rectification or loss beyond normal limits are written off in Costing Profit and Loss Account. |

| Loss due to abnormal reasons |

In this case cost of rectification and loss is treated as abnormal cost and the cost of rectification or loss is written off as loss in Costing Profit and Loss Account. |

4. BATCH COSTING

Batch Costing is a type of specific order costing where articles are manufactured in predetermined lots, known as batch. Under this costing method, the cost object for cost determination is a batch for production rather output as seen in unit costing method.

A batch consists of certain number of units which are processed simultaneously to be for manufacturing operation. Under this method of manufacturing, the inputs are accumulated in the assembly line till it reaches minimum batch size. Soon after a batch size is reached, all inputs in a batch is processed for further operations.

Reasons for batch manufacturing may be either technical or economical or both. For example, in pen manufacturing industry, it would be too costly to manufacture one pen of a particular design at a time to meet the demand of one customer. On the other hand, the production, of say 10,000 pens, of the same design will reduce the cost to a sizeable extent.

To initiate production process, an entity has to incur expenditures on engaging workers for production and supervision, setting-up of machine to run for production etc. These are the minimum level of expenditures which have to be incurred each time a batch is run irrespective of number of units produced.

5. COSTING PROCEDURE IN BATCH COSTING

To facilitate convenient cost determination, one number is allotted for each batch. Material cost for the batch is arrived at on the basis of material requisitions for the batch and labour cost is arrived at by multiplying the time spent on the batch by direct workers as ascertained from time cards or job tickets. Overheads are absorbed on some suitable basis like machine hours, direct labour hours etc.

6. ECONOMIC BATCH QUANTITY (EBQ)

As the product is produced in batches or lots, the lot size chosen will be critical in achieving least cost of operation. Primarily, the total production cost under batch production comprises of two main costs, namely,

- Machine Set Up Costs and

- Inventory holding costs.

If the size is higher, the set up cost may decline due to lesser number of set ups required; but units in inventory will go up leading to higher holding costs. If the lot size is lower, lower inventory holding costs are accomplished but only with higher set up costs. Economic batch quantity is the size of a batch where total cost of set-up and holding costs are at minimum.

This relationship is explained with the help of following diagram

As can be seen in the above diagram, costs are shown on the Y axis and Batch size or batch quantity is shown on the X axis. With the higher batch size, holding cost shows a tendency to increase whereas set-up costs show a declining trend. The point where both the cost lines intersect each other represents the lowest cost combination.

The economic batch size or Economic Batch Quantity may be determined by calculating the total cost for a series of possible batch sizes and checking which batch size gives the minimum cost. Alternatively, a formula can be derived which is similar to determination of Economic Order Quantity (EOQ). The objective here being to determine the production lot (Batch size) that optimizes on both set up and inventory holding cots formula. The mathematical formula usually used for its determination is as follows:

Where,

D = Annual demand for the product

S = Setting up cost per batch

C = Carrying cost per unit of production

7. DIFFERENCE BETWEEN JOB AND BATCH COSTING

| Job Costing |

Batch Costing |

| Method of costing used for non-standard and non-repetitive products produced as per customer specifications and against specific orders. |

Homogenous products produced in a continuous production flow in lots. |

| Cost determined for each job. |

Cost determined in aggregate for the entire Batch and then arrived at on per unit basis. |

| Jobs are different from each other and independent of each other. Each job is unique. |

Products produced in a batch are homogenous and lack of individuality. |