PROCESS & OPERATION COSTING

Table of content

1. MEANING OF PROCESS COSTING

Process Costing is a method of costing used in industries where the material has to pass through two or more processes for being converted into a final product. It is defined as “a method of Cost Accounting whereby costs are charged to processes or operations and averaged over units produced”. A separate account for each process is opened and all expenditure pertaining to a process is charged to that process account. Such type of costing method is useful in the manufacturing of products like steel, paper, medicines, soaps, chemicals, rubber, vegetable oil, paints, varnish etc. where the production process is continuous and the output of one process becomes the input of the following process till completion.

This can be understood with the help of the following diagram:

Basic features

Industries, where process costing can be applied, have normally one or more of the following features:

- Each plant or factory is divided into a number of processes, cost centres or departments, and each such division is a stage of production or a process.

- Manufacturing activity is carried on continuously by means of one or more process run sequentially, selectively or simultaneously.

- The output of one process becomes the input of another process.

- The end product usually is of like units not distinguishable from one another.

- It is not possible to trace the identity of any particular lot of output to any lot of input materials. For example, in the sugar industry, it is impossible to trace any lot of sugar bags to a particular lot of sugarcane fed or vice versa.

- Production of a product may give rise to Joint and/or By-Products.

2. COSTING PROCEDURE IN PROCESS COSTING

The Cost of each process comprises the cost of:

- Materials

- Employee Cost (Labour)

- Direct expenses, and

- Overheads of production.

Materials - Materials and supplies which are required for each process are drawn against Material Requisitions Notes from the stores. Each process for which the materials are used, are debited with the cost of materials consumed on the basis of the information received from the Cost Accounting department. The finished product of first process generally become the raw materials of second process; under such a situation the account of second process is debited with the cost of transfer from the first process and also with the cost of any additional material used in process.

Employee Cost (Labour) - Each process account should be debited with the labour cost or wages paid to labour for carrying out the processing activities. Sometimes the wages paid are apportioned over the different processes after selecting appropriate basis.

Direct expenses - Each process account should be debited with direct expenses like depreciation, repairs, maintenance, insurance etc. associated with it.

Production Overheads- Expenses like rent, power expenses, lighting bills, gas and water bills etc. are known as production overheads. These expenses cannot be allocated to a process. The suitable way out to recover them is to apportion them over different processes by using suitable basis. Usually, these expenses are estimated in advance and the processes debited with these expenses on a pre- determined basis.

3. TREATMENT OF NORMAL, ABNORMAL LOSS AND ABNORMAL GAIN

Normal and abnormal loss:

Loss of material is inherent during processing operation. The loss of material under different processes arises due to reasons like evaporation or a change in the moisture content etc. Process loss is defined as the loss of material arising during the course of a processing operation and is equal to the difference between the input quantity of the material and its output.

There are two types of material losses viz.

- Normal loss

- Abnormal loss.

(i) Normal Process Loss: It is also known as normal wastage. It is defined as the loss of material which is inherent in the nature of work. Such a loss can be reasonably anticipated from the nature of the material, nature of operation, the experience and technical data. It is unavoidable because of nature of the material or the process. It also includes units withdrawn from the process for test or sampling.

Treatment in Cost Accounts: The cost of normal process loss in practice is absorbed by good units produced under the process. The amount realised by the sale of normal process loss units should be credited to the process account.

Example-1 (Normal loss with no realisable value)

A product passes through Process- I and Process- II. Materials issued to Process- I amounted to Rs.40,000, Wages Rs.30,000 and manufacturing overheads were Rs.27,000. Normal loss anticipated was 5% of input. 4,750 units of output were produced and transferred-out from Process-I. There were no opening stocks. Input raw material issued to Process I were 5,000 units. Scrap has no realisable value.

You are required to PREPARE Process- I account, value of normal loss and units transferred to Process-II.

Solution

Process- I Account

| Particulars |

Units |

Amount |

Particulars |

Units |

Amount |

| To Material |

5,000 |

40,000 |

By Normal Loss |

250 |

0 |

| To Wages |

- |

30,000 |

|

|

|

| To Overhead |

- |

27,000 |

By Process II |

4,750 |

97,000 |

| |

5,000 |

97,000 |

|

5,000 |

97,000 |

Value of Normal loss = Scrap realisable value less cost to sale

Since, scraps do not realise any value, hence, value of normal loss is zero.

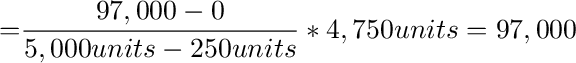

Value of units transferred to Process-II:

Example-2

Example-2 (Normal loss with realisable value)

A product passes through Process- I and Process- II. Materials issued to Process- I amounted to Rs.40,000, Wages Rs.30,000 and manufacturing overheads were Rs.27,000. Normal loss anticipated was 5% of input. 4,750 units of output were produced and transferred-out from Process-I. There were no opening stocks. Input raw material issued to Process I were 5,000 units. Scrap has realisable value of Rs.2 per unit.

You are required to PREPARE Process- I account, value of normal loss and units transferred to Process-II.

Solution

Process- I Account

| Particulars |

Units |

Amount |

Particulars |

Units |

Amount |

| To Material |

5,000 |

40,000 |

By Normal Loss |

250 |

500 |

| To Wages |

- |

30,000 |

|

|

|

| To Overhead |

- |

|

By Process II |

4,750 |

96,500 |

| |

5,000 |

97,000 |

|

5,000 |

97,000 |

Value of Normal loss = Scrap realisable value less cost to sale

= 250 units × Rs.2 = Rs.500

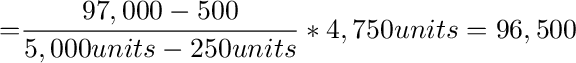

Value of units transferred to Process-II:

(ii) Abnormal Process Loss:

(ii) Abnormal Process Loss: It is also known as abnormal wastage. It is defined as the loss in excess of the pre-determined loss (Normal process loss). This type of loss may occur due to the carelessness of workers, a bad plant design or operation, sabotage etc. Such a loss cannot obviously be estimated in advance. But it can be kept under control by taking suitable measures.

Treatment in Cost Accounts: The cost of an abnormal process loss unit is equal to the cost of a good unit. The total cost of abnormal process loss is credited to the process account from which it arises. Cost of abnormal process loss is not treated as a part of the cost of the product. In fact, the total cost of abnormal process loss is debited to costing profit and loss account.

Example-3 (Abnormal loss with realisable value)

A product passes through Process- I and Process- II. Materials issued to Process- I amounted to Rs.40,000, Wages Rs.30,000 and manufacturing overheads were Rs.27,000. Normal loss anticipated was 5% of input. 4,550 units of output were produced and transferred-out from Process-I. There were no opening stocks. Input raw material issued to Process I were 5,000 units. Scrap has realisable value of Rs.2 per unit.

You are required to PREPARE Process- I account, value of normal loss, abnormal loss and units transferred to Process-II.

Solution:

Process- I Account

| Particulars |

Units |

Amount |

Particulars |

Units |

Amount |

| To Material |

5,000 |

40,000 |

By Normal Loss |

250 |

500 |

| To Wages |

- |

30,000 |

By Abnormal Loss |

200 |

4,063 |

| To Overhead |

- |

27,000 |

By Process II |

4,550 |

92,437 |

| |

5,000 |

97,000 |

|

5,000 |

97,000 |

Value of Normal loss = Scrap realisable value less cost to sale

= 250 units × Rs.2 = Rs.500

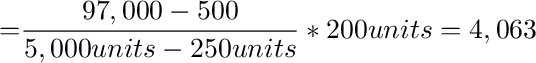

Value of Abnormal loss:

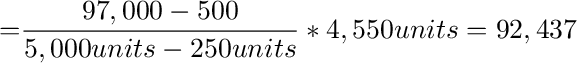

Value of units transferred to Process-II:

Abnormal Process Gain/ Yield:

Sometimes, loss under a process is less than the anticipated normal figure. In other words, the actual production exceeds the expected figures. Under such a situation the difference between actual and expected loss or actual and expected production is known as abnormal gain or yield. So, abnormal gain may be defined as an unexpected gain in production under the normal conditions. This arises due to over- estimation of process loss, improvements in work efficiency of workers, use od better technology in production etc.

Treatment in Cost Accounts: The process account under which abnormal gain arises is debited with the abnormal gain and credited to abnormal gain account which will be closed by transferring to the Costing Profit and Loss account. The cost of abnormal gain is computed on the basis of normal production.

Example-4 (Abnormal gain/ yield with realisable value)

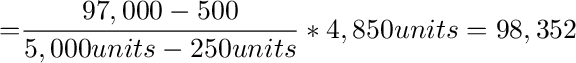

A product passes through Process- I and Process- II. Materials issued to Process- I amounted to Rs.40,000, Wages Rs.30,000 and manufacturing overheads were Rs.27,000. Normal loss anticipated was 5% of input. 4,850 units of output were produced and transferred-out from Process-I. There were no opening stocks. Input raw material issued to Process I were 5,000 units. Scrap has realisable value of Rs.2 per unit.

You are required to PREPARE Process- I account, value of normal loss, abnormal loss/ gain and units transferred to Process-II.

Solution

Process- I Account

| Particulars |

Units |

Amount |

Particulars |

Units |

Amount |

| To Material |

5,000 |

40,000 |

By Normal Loss |

250 |

500 |

| To Wages |

- |

30,000 |

|

|

|

| To Overhead |

- |

27,000 |

By Process II |

4,850 |

98,532 |

| To Abnormal Gain A/c |

100 |

2,032 |

|

|

|

| |

5,100 |

99,032 |

|

5,100 |

99,032 |

Value of Normal loss = Scrap realisable value less cost to sale

= 250 units × Rs.2 = Rs.500

(even though the actual loss is less than the expected loss (Normal loss), value of the normal loss is calculated on the estimated figure)

Value of Abnormal Gain:

(Process A/c is debited with the value of abnormal gain as calculated above but the Costing Profit & Loss Account will only be credited with actual amount of abnormal gain only considering the actual realisable value through Abnormal Gain A/c, as shown below)

Abnormal Gain A/c

| Particulars |

Units |

Amount |

Particulars |

Units |

Amount |

To Normal Loss A/c

(100 units x 2) |

100 |

200 |

By Process I A/c |

100 |

2,032 |

| To Costing P&L A/c |

- |

1,832 |

|

|

|

| |

100 |

2,032 |

|

100 |

2,032 |

(The Costing P&L Account is credited only for actual gain amount)

4. VALUATION OF WORK IN PROCESS

In the case of process type of industries, it is possible to determine the average cost per unit by dividing the total cost incurred during a given period of time by the total number of units produced during the same period. But this is hardly the case in most of the process type industries where manufacturing is a continuous activity. The reason is that the cost incurred in such industries represents the cost of work carried on opening work-in-process, closing work-in-process and completed units. Thus to ascertain the cost of each completed unit, it is necessary to ascertain the cost of work-in-process in the beginning and at the end of the process.

The valuation of work-in-process presents a good deal of difficulty because it has units under different stages of completion from those in which work has just begun to those which are only a step short of completion. Work-in-process can be valued on actual basis, i.e., materials used on the unfinished units and the actual amount of labour expenses involved. However, the degree of accuracy in such a case cannot be satisfactory. An alternative method is based on converting partly finished units into equivalent finished units.

Equivalent Units

Equivalent units or equivalent production units, means converting the incomplete production units into their equivalent completed units. Under each process, an estimate is made of the percentage completion of work-in-process with regard to different elements of costs, viz., material, labour and overheads. It is important that the estimate of percentage of completion should be as accurate as possible. The formula for computing equivalent completed units is:

Equivalent completed units = (Actual number of units in the process of amnufacture) x (Percentage of work completed)

For instance, if 25% of work has been done on the average of units still under process, then 200 such units will be equal to 50 completed units and the cost of work-in-process will be equal to the cost of 50 finished units.

The following table may be used to compute the equivalent units:

| Input Details |

Units |

Output Particulars |

Units |

Equivalent Units |

| Material |

Labour |

Overhead |

| % |

Units |

% |

Units |

% |

Units |

| |

|

|

a |

b |

c=a x b |

d |

e=a x d |

f |

g=a x f |

| Opening WIP |

xxx |

Opening WIP* |

xxx |

xxx |

xxx |

xxx |

xxx |

xxx |

xxx |

| Unit Intrdoduced |

xxx |

Finished Output** |

xxx |

xxx |

xxx |

xxx |

xxx |

xxx |

xxx |

| |

|

Normal Loss*** |

xxx |

- |

- |

- |

- |

- |

- |

| |

|

Abnormal Loss/Gain**** |

xxx |

xxx |

xxx |

xxx |

xxx |

xxx |

xxx |

| |

|

Closing WIP |

xxx |

xxx |

xxx |

xxx |

xxx |

xxx |

xxx |

| Total |

xxx |

Total |

xxx |

|

xxx |

|

xxx |

|

xxx |

* Equivalent units for Opening W-I-P is calculated only under FIFO method. Under the Average method, it is not shown separately.

**Under the FIFO method, Finished Output = Units completed and transferred to next process less Opening WIP. Under Average method, Finished Output = Units completed and transferred.

***For normal loss, no equivalent unit is calculated.

****Abnormal Gain/ Yield is treated as 100% complete in respect of all cost elements irrespective of percentage of completion.

5. STEPS IN PROCESS COSTING

For each production process, a Production Cost Report is prepared at the end of each accounting period. The objective of preparing the report is to know physical units and equivalent units in process, element wise cost of goods produced and transferred, goods in process (work-in-process), units lost due to abnormal reasons i.e. abnormal loss etc. To prepare the report, the following steps are generally followed:

Step-1: Analysis of physical flow of production units

The first step is to determine and analyse the number of physical units in the form of inputs (introduced fresh or transferred from previous process, beginning work- in-process) and outputs (completed and work-in-process).

Step-2: Calculation of equivalent units for each cost elements

The second step is to calculate equivalent units of production for each cost element i.e. for material, labour and overheads. It is calculated by taking the extent of work done in respect of each element. For example, if there are 1,000 units in work-in-process at the end of the month. All materials are introduced at the beginning of production process. For labour and overheads, 20% more work is required to get it completed. In this example, the equivalent units of work-in- process in respect of material would be 1,000 units (1,000 units × 100% complete) and for labour and overheads 800 units (1,000 units × 80% complete).

Step-3: Determination of total cost for each cost element

Total cost for each cost element is collected and accumulated for the period. The process of cost collection has already been discussed above.

Step-4: Computation of cost per equivalent unit for each cost element

In this step, the cost per equivalent unit for each cost element is calculated. The total cost as calculated in Step-3 is divided by the equivalent units as determined in Step-2.

Step-5: Assignment of total costs to units completed and ending WIP

In this step, the total cost for units completed, units transferred to next process, ending work in process, abnormal loss etc. are calculated and posted in the process account and production cost report.

6. PROCESS COSTING METHODS

Mainly two methods for valuation of work-in-process are followed:

(i) First-in-first-out (FIFO) method

Under this method the units completed and transferred are taken from both opening work-in-process (WIP) and freshly introduced materials/inputs. The cost to complete the opening WIP and other completed units are calculated separately. The cost of opening WIP is added to cost incurred on completing the incomplete (WIP) units into complete one. The total cost of units completed and transferred is calculated by adding opening WIP cost to cost on freshly introduced inputs. In this method the closing stock of work in process is valued at current cost.

(ii) Weighted Average (Average) Method:

Under this method, the cost of opening work-in-process and cost of the current period are aggregated and the aggregate cost is divided by output in terms of completed units. The equivalent production in this case consists of work-load already contained in opening work-in-process and work-load of current period.

The main difference between FIFO method and average method is that units of opening work in process and their cost are taken in full under average method while under FIFO method only the remaining work done now is considered.

7. INTER-PROCESS PROFITS

To control cost and to measure performance, different processes within an organization are designated as separate profit centres. In this type of organizational structure, the output of one process is transferred to the next process not at cost but at market value or cost plus a percentage of profit. The difference between cost and the transfer price is known as inter-process profits.

The advantages and disadvantages of using inter-process profit, in the case of process type industries are as follows:

Advantages:

- Comparison between the cost of output and its market price at the stage of completion is facilitated.

- Each process is made to stand by itself as to the profitability.

Disadvantages:

- The use of inter-process profits involves complication.

- The system shows profits which are not realised because of stock not sold out.

8. OPERATION COSTING

This product costing system is used when an entity produces more than one variant of final product using different materials but with similar conversion activities. Which means conversion activities are similar for all the product variants but materials differ significantly. Operation Costing method is also known as Hybrid product costing system as materials costs are accumulated by job order or batch wise but conversion costs i.e. labour and overheads costs are accumulated by department, and process costing methods are used to assign these costs to products. Moreover, under operation costing, conversion costs are applied to products using a predetermined application rate. This predetermined rate is based on budgeted conversion costs.

For example, a company is manufacturing two grades of products, Product- Deluxe and Product- Regular. Both the products pass through a similar production process but require different quality and quantities of raw materials. The cost of raw material is accumulated on the basis of job or batches or units of two variants of products. But the costs for the conversion activities need not to be identified with the product variants as both the Products requires similar activities for conversion. Hence, conversion activity costs are accumulated on the basis of departments or processes only. Example of industries are ready made garments, Shoe making, jewelry etc.