CMA Inter Suggested Answers | Dec 24 Paper 10 Corporate Accounting and Auditing (CAA)

Table of Contents

CMA Inter Dec 24 Suggested Answer Other Subjects Blogs :

MCQs

(i) Which of the following is not a statutory book of a company?

Answer :

Statutory books are those which a limited company is under statutory obligation to maintain at its registered office as per the provisions of different Sections of the Act. The most important statutory books are:

(i) Register of Investments held and their names (ii) Register of charges (iii) Register of Members (iv) Register of debenture holders (v) Annual returns (vi) Minutes books (vii)Register of contracts (viii)Register of Directors (ix) Register of shareholdings of the directors (x) Register of loans to companies under the same management (xi) Register of Investment in the shares of other companies.

(ICMAI book page number 6 | This Question is also a part of www.konceptca.com Question Bank)

(ii) Company may purchase its own shares or other specific securities out of

1. Free reserves

2. Securities premium account

3. Proceeds of issue of any shares

4. Proceeds of issue of specified securities

Answer :

Under Section 68 of the Companies Act, 2013, a company may purchase its own shares or specified securities (buy-back) from the following sources:

These provisions allow buy-back from any of these sources, making option (D) correct.

(ICMAI book page number 69 | This Question is also a part of www.konceptca.com Question Bank)

(iii) Which of the following is/are not a criteria to classify a liability as current liability?

Answer :

(B) It is held primarily not for the purpose of being traded.

A liability is classified as current if it meets any of the following criteria as per Schedule III of the Companies Act, 2013 and relevant accounting standards (Ind AS 1):

Option (B) contradicts the definition of a current liability, as a liability held "not for the purpose of being traded" does not meet the conditions for classification as current liability.

(ICMAI book page number 151 | This Question is also a part of www.konceptca.com Question Bank)

(iv) In the Notes to Accounts, Contingent Liabilities shall be classified as______

Answer :

As per Schedule III of the Companies Act, 2013, contingent liabilities in the Notes to Accounts must be classified under the following categories:

This ensures comprehensive disclosure of potential obligations that may impact the company's financial position in the future.

(ICMAI book page number 170 | This Question is also a part of www.konceptca.com Question Bank)

(v) Which of the following is not a mandatory financial statement of a General Insurance company as per IRDA regulations?

Answer :

As per the IRDA (Insurance Regulatory and Development Authority of India) Regulations, the mandatory financial statements for a General Insurance company are:

The Cash Flow Statement is not listed as a mandatory statement under IRDA regulations for General Insurance companies.

(ICMAI book page number 375 | This Question is also a part of www.konceptca.com Question Bank)

(vi) SA 600 deals in matters connected with __________.

Answer :

(A) Using the work of another Auditor.

The other options relate to different Standards on Auditing:

(ICMAI book page number 471 | This Question is also a part of www.konceptca.com Question Bank)

(vii) As per SQC 1, the audit working papers must be retained by the statutory auditors for a period of __________ years.

Answer :

(C) seven

(ICMAI book page number 476 | This Question is also a part of www.konceptca.com Question Bank)

(viii) Audit Documentation is related to __________.

Answer :

(B) SA 230.

(ICMAI book page number 471 | This Question is also a part of www.konceptca.com Question Bank)

(ix) A Cost Auditor submits his report along with reservations and observations in Form No. __________.

Answer :

(C) CRA 3.

(ICMAI book page number 606 | This Question is also a part of www.konceptca.com Question Bank)

(x) Which of the following is/are the benefits of Internal Financial Control?

Answer :

(D) All of the above.

Benefits of Internal Financial Control With adequate and effective internal financial controls, some of the benefits that the companies would experience include:

Senior Management Accountability, Improved controls over financial reporting process, Improved investor confidence in entity’s operations and financial reporting process, Promotes culture of openness and transparency within the entity, Trickling down of accountability to operational management, Improvements in Board, Audit Committee and senior management engagement in financial reporting and financial controls, More accurate, reliable financial statements, Making audits more comprehensive.

(ICMAI book page number 498 | This Question is also a part of www.konceptca.com Question Bank)

(xi) The statutory auditor apprehends a possible material misstatement due to inadequate internal check system. The risk associated with this apprehension is known as

Answer :

(C) Control Risk.

(ICMAI book page number 482 | This Question is also a part of www.konceptca.com Question Bank)

(xii) In relation to advances made by bank, an Auditor needs to review which of the following?

Answer :

Advances: In relation to advances made by bank an auditor needs to review the followings:

Ensure that the internal control is in place in relation to advances made. Scrutinise the subsidiary, ledger, & control accounts Ensure the proper documentation of account. Scrutinise the overdue account and scheme for recovery of such amount.

(ICMAI book page number 623 | This Question is also a part of www.konceptca.com Question Bank)

(xiii) Which of the following is not a part of Temporary Audit file?

Answer :

(D) Legal and organization structure of the company.

(ICMAI book page number 513 | This Question is also a part of www.konceptca.com Question Bank)

(xiv) Which of the following is not a content of audit report as per CARO?

Answer :

(ICMAI book page number 495 | This Question is also a part of www.konceptca.com Question Bank)

(xv) Reappointment of Company Auditor is guided by section ________ of Companies Act, 2013.

Answer : (D) 139(9)

(ICMAI book page number 524 | This Question is also a part of www.konceptca.com Question Bank)

Question 2 (a)

P Ltd. issued 6,000 equity shares of ₹10 each payable as ₹3 per share on Application, ₹2 per share (including ₹2 as premium) on Allotment and ₹4 per share on Call. All the shares were subscribed. Money due on all shares was fully received except M, holding 100 shares, failed to pay the Allotment and Call money and N, holding 200 shares, failed to pay the Call Money. All those 300 shares were forfeited. Of the shares forfeited, 250 shares (including whole of M's shares) were subsequently reissued as fully paid up at a price of ₹8 per share. Prepare necessary entries (with narration) in the Journal of the company to record the forfeiture and reissue. Working should form part of your answer.

Answer :

Question 2 (b)

Akash Ltd. has issued 2,000, 12% convertible debentures of ₹100 each redeemable after a period of five years. According to the terms and conditions of the issue, the debentures were redeemable at a premium of 5%. The debenture holders also had the option at the time of redemption to convert 20% of their holdings into equity shares of ₹10 each at a price of ₹20 per share and get the balance in cash. Debenture holders amounting ₹40,000 opted to get their debentures converted into equity shares as per terms of the issue. You are required to

Answer :

Question 3

Alpha Ltd. provides the following Trial Balance as on 31st March, 2024:

|

Particulars |

Dr. Balances (₹) |

Cr. Balances (₹) |

|

Equity Share Capital: 300000 shares of ₹10 each fully paid |

|

30,00,000 |

|

General reserve |

|

2,00,000 |

|

Profit and Loss Balance (Cr.) |

|

3,00,000 |

|

10% Debentures |

|

3,00,000 |

|

Motor Van |

4,00,000 |

|

|

Particulars |

Dr. Balances (₹) |

Cr. Balances (₹) |

|

Machinery |

20,00,000 |

|

|

Building |

12,00,000 |

|

|

12% Long Term Govt. Securities |

2,00,000 |

|

|

Sales |

|

60,00,000 |

|

Sales Return |

30,00,000 |

|

|

Interest on Debenture |

22,500 |

|

|

Purchase |

36,00,000 |

|

|

Purchase Returns |

|

4,00,000 |

|

Opening Stock |

3,00,000 |

|

|

Discount Allowed |

7,500 |

|

|

Carriage Outward |

1,50,000 |

|

|

Rent and Rates |

50,000 |

|

|

Income from Govt. Securities |

|

24,000 |

|

Trade Receivables |

10,00,000 |

|

|

Trade Payables |

|

2,00,000 |

|

Advertisement |

1,50,000 |

|

|

Bad Debt |

20,000 |

|

|

Salaries |

6,72,000 |

|

|

Misc. Expenditure |

30,000 |

|

|

Contribution to P.F. and Gratuity Funds |

1,00,000 |

|

|

Cash at Bank and in hand |

2,22,000 |

|

|

Total |

1,04,24,000 |

1,04,24,000 |

Additional Information:

(i) Closing Stock as on 31st March, 2024 was ₹3,50,000.

(ii) Depreciation Rates: Motor Vehicle 10%, Machinery 20%, and Building 5%.

(iii) Interest on debenture is payable quarterly and the last quarter’s interest is yet to be paid.

(iv) Trade receivables include a sum of ₹25,000 due from Mr. X who has become insolvent and only 25 paisa in a rupee is expected to be recoverable from him. Create a provision for doubtful debt @ 2% on other trade receivables.

(v) Provide for income tax ₹1,50,000.

What is the life assurance fund after taking into account the above omissions?

Answer :

Question 4 (a)

The books of a Bank include a loan of ₹15,00,000 advanced on 31.12.2022, interest chargeable @ 10% p.a. compounded quarterly.

The security for the loan is 21,000 shares of ₹100 each in a public limited company valued @ ₹80 each. There is no repayment till 31.03.2024 (including accrued Interest). On 31.03.2024, the value of shares declined to ₹70 per share.

How would you classify the loan as secured or unsecured in the Balance Sheet? State with reasons.

Answer :

Question 4 (b)

The Revenue Account of an Insurance company shows the life assurance fund on 31st March 2023 at ₹30,00,000 before taking into account the following items:

What is the life assurance fund after taking into account the above omissions?

Answer :

Question 5 (a)

Consider the following information:

No. of employees (same as the previous year) = 450

Employees’ turnover rate = 8%

Bonus paid to each employee last year = ₹3,00,000

Increase in bonus rate due to inflation = 6% (as per company’s regular practice)

Calculate the liability and expense to be recognized as per Ind AS-19. Also state under which category this type of Employee Benefit will be classified:

(i) Short Term

(ii) Post employment

(iii) Other long term

(iv) Termination

Answer :

Question 5 (b)

The following figures have been extracted from the books of Y Ltd. for the year ended on 31.03.2024, you are required to work out Cash Flow from Operating Activities.

(i) Net profit before taking into account Income Tax but after taking into account the following items was ₹10 lakhs:

(ii) Income tax paid during the year ₹5,25,000.

(iii) Non-cash Working capital on 1.4.2023 ₹5,86,000 and on 31.3.2024 ₹6,39,000.

Answer :

Question 6 (a)

Describe the essential characteristics of a sound internal check system.

Answer :

Question 6 (b)

Illustrate the provisions of Companies Act, 2013 and SEBI Regulations relating to the applicability and conduct of Secretarial Audit.

Answer :

Question 7 (a)

State the differences between Audit report and Audit certificate.

Answer :

Question 7 (b)

Explain, in detail, the Role of NFRA (National Financial Reporting Authority).

Answer :

Question 8 (a)

Mr. A has been appointed as the Auditor of XYZ Co-operative Society for the financial year 2023-24. Mr. A seeks your opinion in designing an elaborate plan for this assignment. Prepare and suggest a list of important steps to be taken by Mr. A in conducting the audit of XYZ Co-operative Society.

Answer :

Question 8 (b)

Discuss the provisions of the Companies Act, 2013 regarding appointment of first Auditor of a company.

Answer :

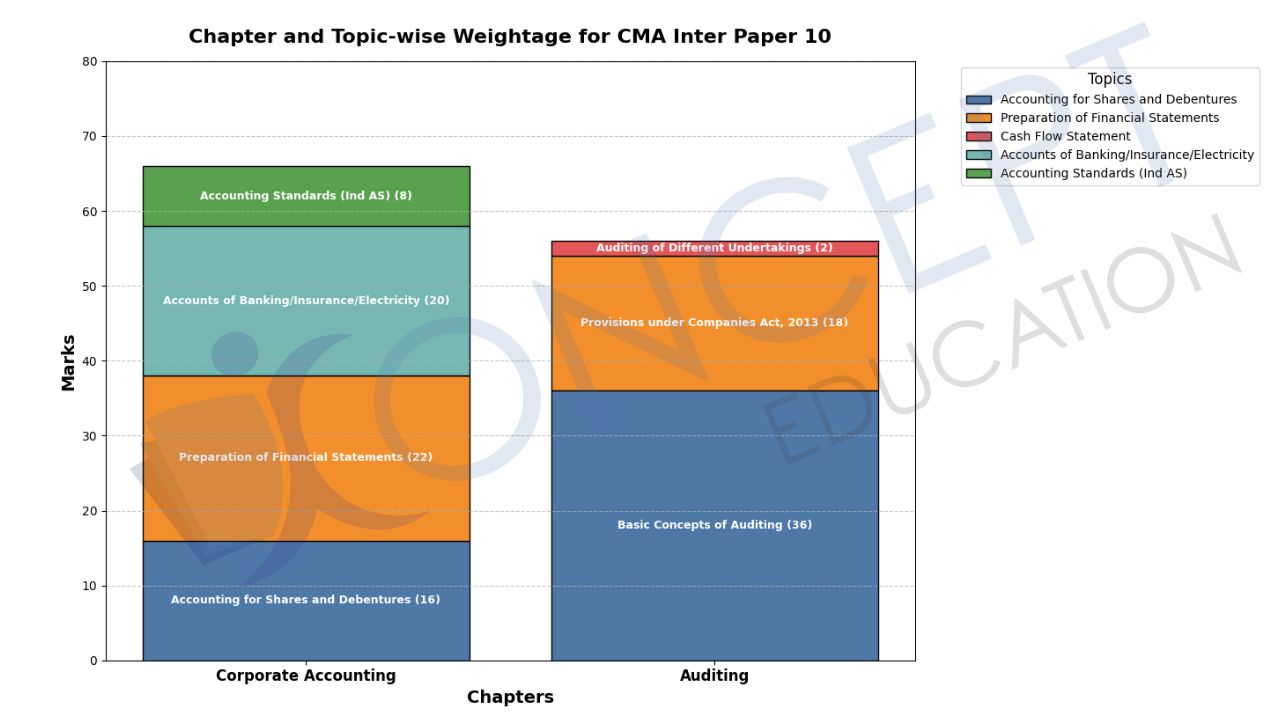

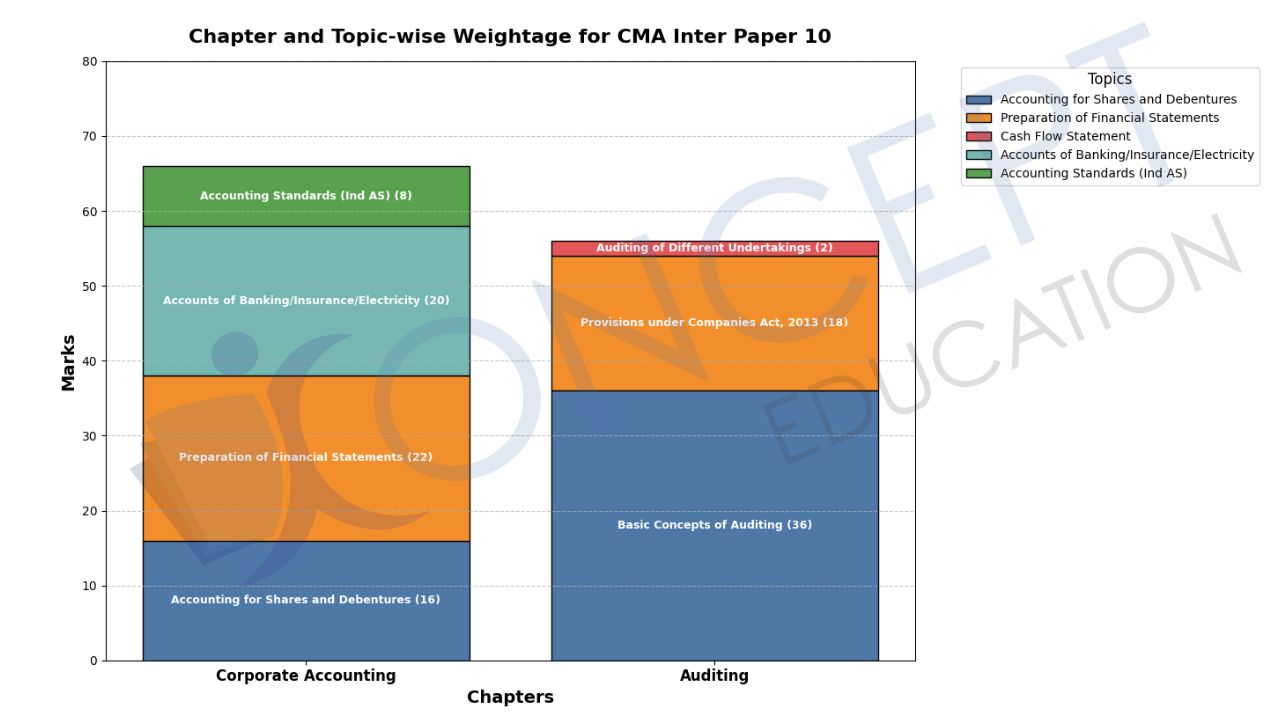

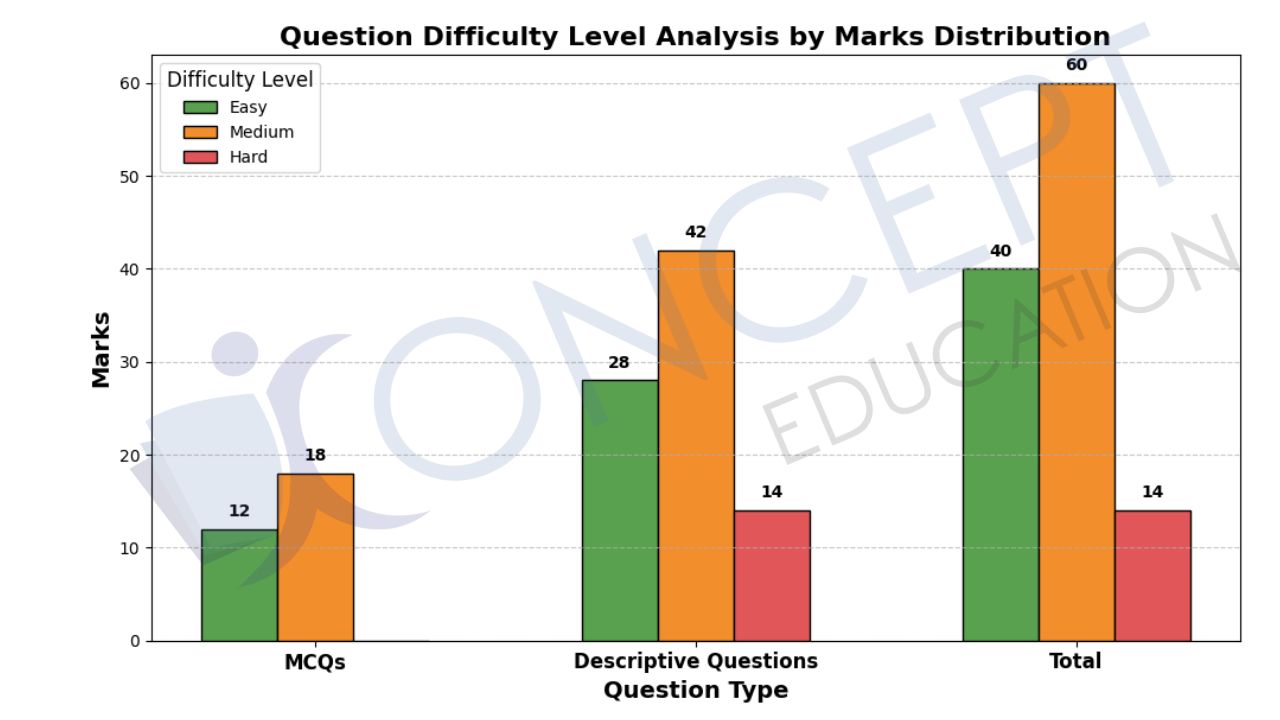

Corporate Accounting and Auditing detailed analysis

Ruchika Ma'am has been a meritorious student throughout her student life. She is one of those who did not study from exam point of view or out of fear but because of the fact that she JUST LOVED STUDYING. When she says - love what you study, it has a deeper meaning.

She believes - "When you study, you get wise, you obtain knowledge. A knowledge that helps you in real life, in solving problems, finding opportunities. Implement what you study". She has a huge affinity for the Law Subject in particular and always encourages student to - "STUDY FROM THE BARE ACT, MAKE YOUR OWN INTERPRETATIONS". A rare practice that you will find in her video lectures as well.

She specializes in theory subjects - Law and Auditing.

Yash Sir (As students call him fondly) is not a teacher per se. He is a story teller who specializes in simplifying things, connecting the dots and building a story behind everything he teaches. A firm believer of Real Teaching, according to him - "Real Teaching is not teaching standard methods but giving the power to students to develop his own methods".

He cleared his CA Finals in May 2011 and has been into teaching since. He started teaching CA, CS, 11th, 12th, B.Com, M.Com students in an offline mode until 2016 when Konceptca was launched. One of the pioneers in Online Education, he believes in providing a learning experience which is NEAT, SMOOTH and AFFORDABLE.

He specializes in practical subjects – Accounting, Costing, Taxation, Financial Management. With over 12 years of teaching experience (Online as well as Offline), he SURELY KNOWS IT ALL.