CMA Inter Suggested Answers | Dec 24 Paper 07 Direct and Indirect Taxation (DITX)

Table of Contents

CMA Inter Dec 24 Suggested Answer Other Subjects Blogs :

MCQs

(i) Mr. Sunil’s minor daughter earned ₹ 50,000 from her special talent. Under the Income Tax Act, 1961, this income will be clubbed with—

Solution :

The income earned by a minor child from their special talent (such as acting, singing, or any other unique capability) is not clubbed with the income of the parent under Section 10(32) of the Income Tax Act, 1961. This income qualifies as an exemption since it is earned using the child's own skill or talent.

Hence, the correct answer is:

For a detailed reference, this is explained under the provision of clubbing of income under Section 64(1A) and the related exemption under Section 10(32).

(Similar Question was part of www.konceptca.com Question Library)

(ii) As per the Income Tax Act, 1961, in case of loss, a partnership firm may claim deduction in respect of remuneration paid to partner to the extent of

Solution :

(B) ₹ 1,50,000/- or actual remuneration, whichever is lower.

Under Section 40(b)(v) of the Income Tax Act, 1961, a partnership firm can claim a deduction for remuneration paid to its partners. However, in case of loss, the maximum permissible deduction for remuneration is ₹ 1,50,000 or actual remuneration paid, whichever is lower.

(iii) As per the Income Tax Act, 1961, income from saplings shall be considered as

Solution :

Income from saplings or seedlings grown in a nursery is considered agricultural income under the Income Tax Act, 1961, as per Section 2(1A). This holds true regardless of whether the nursery is maintained on agricultural land or not.

(iv) Exemption under section 54 of the Income Tax Act, 1961 is available to

Solution :

(C) Individuals as well as HUF.

Exemption under Section 54 of the Income Tax Act, 1961, is available to Individuals and Hindu Undivided Families (HUFs). This section allows for exemption on the capital gains arising from the transfer of a residential house, provided the proceeds are reinvested in another residential property within the specified period.

(v) Mr. Nitin had bought a laptop for ₹ 50,000 on 01.04.2021 for his personal use. He started using this laptop for his business purposes only since 02.05.2023. On that date, the market value of the laptop was ₹ 40,000. What is the amount of depreciation allowable to him under the Income Tax Act, 1961 for the financial year 2023-24 assuming the rate of depreciation to be 40%?

(A) ₹ 20,000

(B) ₹ 16,000

(C) ₹ 7,200

(D) ₹ 2,880

Solution :

(A) ₹ 20,000

As per Section 43(1) of the Income Tax Act, 1961, the actual cost of the asset is defined as the cost at which the asset was acquired by the assessee. When an asset is initially used for personal purposes and subsequently brought into business use, the original purchase price is considered as the actual cost, not the market value on the date it is brought into business use.

In this case:

Depreciation Calculation: Depreciation = ₹ 50,000 × 40% = ₹ 20,000

Notes:

(vi) Mr. Raina, a resident individual, files all his income tax returns on time. He has opted for default tax regime under section 115BAC of the Income Tax Act, 1961 for the Assessment year 2024-25. During the year he withdrew the following sums in cash from his savings bank account maintained with ABC Bank (ABC Bank is not a co-operative bank):

Which of the following statements is correct in this respect?

Solution :

(B) ABC Bank will need to deduct TDS at the rate of 2%.

Relevant Provisions of Section 194N:

(vii) As per the GST law, renting of precincts of a religious place meant for general public owned or managed by a charitable or religious trust u/s 12AA of the Income Tax Act, 1961, shall be exempt if

Solution :

(D) All of the above

Exemptions on Renting of Premises:

(viii) A hotel owner provided accommodation in Haryana, through an Electronic Commerce Operator (ECO). The hotel owner is not liable to get registered as per the provisions of section 22(1) of the CGST Act, 2017. Who is the person liable to pay GST in this case?

Solution :

(B) Electronic Commerce Operator (ECO)

Under Section 9(5) of the CGST Act, 2017, for certain services provided through an Electronic Commerce Operator (ECO), the liability to pay GST is shifted to the ECO. This is applicable to services such as:

Applicability in the Given Scenario:

(ix) The items which will be taxable both under current central excise law and new GST even after the implementation of the GST law:

Solution :

(C) Tobacco and Tobacco products

Taxability of Specific Items:

(x) As per the GST law, tax invoice shall be prepared in _______ in case of supply of goods and in _______ in case of supply of services.

Solution :

Under the GST law, the requirement for the preparation of tax invoices is outlined in Rule 46 of the CGST Rules, 2017. The number of copies required depends on whether the supply involves goods or services:

Requirements:

(xi) As per the Customs Act, 1962, Goods which are same in all respects, including physical quantity is known as:

Solution :

(A) Identical Goods

If goods meet these criteria but are not exactly identical, they might qualify as similar goods instead.

(xii) The maximum threshold limit for eligibility under composition scheme for supplier of services under section 10(2A) of the CGST Act, 2017 is

Solution :

(B) ₹ 50 lakh

(xiii) Mr. Prashant works with ABC Ltd. as a Senior Manager since 1.4.2019. On 11.05.2023, the company gave him a cash gift of ₹ 55,000 for his contribution in acquiring a new client. Which of the following statements is correct with reference to GST law?

Solution :

(B) The gift received from employer is fully taxable under GST as the amount exceeds ₹ 50,000

Further, proviso to Para 2 of Schedule I provides that gifts upto ₹ 50,000 in value in a financial year by an employer to an employee shall not be treated as supply of goods or services or both. However, gifts of value more than ₹ 50,000 made without consideration are supply and are subject to GST, when made in the course or furtherance of business.

(xiv) As per section 2(28) of the Customs Act, 1962, "Indian customs waters" means the waters extending into the sea up to

Solution :

Under Section 2(28) of the Customs Act, 1962, "Indian customs waters" are defined as the waters extending into the sea up to 24 nautical miles (NM) from the baseline of the coast of India.

(xv) Mr. Nitesh, a composition dealer under GST exceeded the specified turnover to be eligible for composition scheme on 1st December 2023. Which of the following statements is correct in this respect?

Solution :

This is in accordance with the provisions of Section 10(5) of the CGST Act, 2017, which automatically shifts the dealer to the regular scheme upon exceeding the threshold.

Key Points:

Question 2 (a)

Briefly discuss with reference to Income Tax Act, 1961 whether the followings are capital / revenue receipts/ expenditure for the Assessment Year 2024-25:

(i) Mr. Ratan was employed with a start-up company. The company paid ₹ 12 lakhs as salary to him out of the capital account balance.

(ii) Miss Sunita entered into a bond with her employer company whereby the employer company paid her salary in advance for 3 years, ₹ 30 lakh, on 30.06.2023.

(iii) Mr. Desai purchased a car for the purpose of his business from Mr. Dhawal, who is a car dealer.

(iv) Miss Shreya operates her profession from a rented office. She got the office painted and spent ₹ 1,00,000 on such painting. The paint will last for 5 years.

(v) M/s ABC Ltd. entered into a purchase agreement with the builder of a factory building. On 31st October, 2023, the builder paid ₹ 10 lakh to M/s ABC Ltd. as compensation for delay in giving possession of the factory building. The compensation was decided as per the terms of the agreement between them.

Answer :

(i) The source of payment (capital account) does not determine the nature of the transaction. Salary paid to an employee is a revenue expenditure for the employer and a revenue receipt for the employee.Conclusion: For the employer: Revenue expenditure For Mr. Ratan: Revenue receipt.

(ii) Salary received in advance by the employee is considered revenue in nature for the employee, as it represents compensation for services rendered.Conclusion: For Miss Sunita: Revenue receipt For the employer: Revenue expenditure

(iii) The purchase of a car is a capital expenditure for Mr. Desai as it results in the acquisition of a fixed asset for business use Conclusion: For Mr. Desai: Capital expenditure. For Mr. Dhawal: Revenue receipt

(iv) Miss Shreya: The ₹1,00,000 spent on painting the rented office is revenue expenditure and deductible under Section 37(1). Reasoning: The painting enhances usability but does not create a new asset or provide enduring benefit in the capital sense.

(v) As per judicial rulings, such compensation is treated as a revenue receipt and is taxable under Income from Other Sources (Section 56) For M/s ABC Ltd.: Revenue receipt, taxable under Income from Other Sources.

Question 2 (b)

Mr. Kaul, aged 60 years, retired from a private company on 1st February, 2024. He served as a General Manager in this company for 25 years and 6 months. He was drawing a basic salary of ₹ 95,000 p.m. since 1st January, 2022, dearness allowance of 12% of basic salary (30% forms part of the salary for retirement benefits). He received the following amounts upon retirement:

(i) Gratuity: ₹ 25,00,000 (he is covered by the Payment of Gratuity Act.)

(ii) Leave Salary: ₹ 12,00,000

(He was entitled to 2 months leave per year of service. He took a total of 12 months leave.)

(iii) Commuted pension: ₹ 4,50,000

You are required to compute his income chargeable under the head ‘Salary’ for the Assessment Year 2024-25 assuming he opted out of default tax regime under section 115BAC of the Income Tax Act, 1961.

Answer :

Question 3 (a)

Mr. Ramesh aged 55 years, is an owner of a residential house property. The following particulars of the house for the previous year 2023-24 are as under:

|

Particulars |

Amount (₹) |

|

Municipal value of the property |

9,00,000 |

|

Fair rent |

7,50,000 |

|

Standard rent under the Rent Control Act |

8,50,000 |

The above property was let out for ₹ 70,000 per month for the period April 2023 to January 2024.

Thereafter, the tenant vacated the property and Mr. Ramesh used the house for self-occupation. Rent for the month of January, 2024 could not be realized from the tenant. Mr. Ramesh has not instituted any legal proceedings for recovery of the unpaid rent.

Mr. Ramesh paid municipal taxes @ 10% during the year and paid interest of ₹ 35,000 during the year for amount borrowed towards repairs of the house property.

Calculate the income from "House property" chargeable in the hands of Mr. Ramesh for the Assessment Year 2024-25. Assuming Mr. Ramesh exercise the option of shifting out of the default tax regime provided under section 115BAC of the Income Tax Act, 1961.

Indicate clearly the reasons for treatment of each item.

Answer :

Question 3 (b)

M/s T and U & Co. is a partnership firm having 2 equal partners, Taarak and Umesh. The firm furnishes the following Profit and Loss Account to you relating to the Financial Year 2023-24:

|

Particulars |

Amount (₹) |

Particulars |

Amount (₹) |

|

Rent paid |

45,000 |

Gross Profit |

10,50,000 |

|

Salary paid to employees |

36,000 |

Rent received from let out property |

3,60,000 |

|

General expenses |

60,000 |

|

|

|

Depreciation |

42,000 |

|

|

|

Payment to partners: |

|

|

|

|

(a) Interest to Taresh |

3,00,000 |

|

|

|

(b) Salary to Umesh |

6,40,000 |

|

|

|

Net profit |

2,87,000 |

|

|

|

14,10,000 |

14,10,000 |

Additional Information:

You are required to compute the income under the head ‘Profits and gains from business or profession’ in the hands of M/s T and U & Co. for the Assessment Year 2024-25.

Answer :

Question 4 (a)

Mrs. Parul sold her commercial plot (land) on 1st January, 2024 for ₹ 86,00,000. Value determined for the purpose of stamp duty is ₹ 80,00,000.

Such plot is acquired on 1st April, 2006 for ₹ 1,05,000. Brokerage paid on purchase and transfer of said land are ₹ 5,000 and ₹ 86,000 respectively.

On 1st March, 2024, Mrs. Parul purchased Power Finance Corporation (PFC) Limited bonds of ₹ 60,00,000.

You are required to compute income taxable under the head ‘Capital Gains’ for the Assessment Year 2024-25 in the hands of Mrs. Parul. Assuming Mrs. Parul exercise the option of shifting out of the default tax regime provided under section 115BAC of the Income Tax Act, 1961.

Cost inflation index for the various financial years are as under:

Indicate clearly the reasons for treatment of each item.

Answer :

Question 4 (b)

Mr. Ajit, a resident Indian aged 55 years, a Cost and Management Accountant (CMA), shares the following information about his income during the financial year 2023-24:

(i) Amount received from evaluation of answer books of professional examinations: ₹ 70,000. Expenses incurred for earning this income like cost of stationery etc. ₹ 1,200.

(ii) Income from fixed deposit relating to A.Y. 2023-24: ₹ 45,000 including interest amounting to ₹ 7,000.

(iii) Gift received in cash from his son and his marriage anniversary: ₹ 76,000.

(iv) Gift received from his brother-in-law, Abhijit: ₹ 1,30,000 in cash.

(v) Amount received from letting out of residential house property: ₹ 50,000 p.m.

(vi) Dividend received (gross) from listed Indian companies: ₹ 65,000

(vii) Interest expenses on loan taken to buy the shares on which dividend is received: ₹ 15,000

Compute the income chargeable under the head ‘Income from other sources’ in the hands of Mr. Ajit for the Assessment Year 2024-25 by briefly giving reasons wherever applicable, assuming he has opted for default tax regime under section 115BAC of the Income Tax Act, 1961.

Answer :

Question 5 (a)

Mr. Sumeet, a resident individual aged 35 years, gives the following information to you relating to financial year 2023-24:

(i) Loss from self-occupied property: ₹ 3,40,000

(ii) Income from the business of buying and selling shares of listed companies (there were no delivery of shares involved): ₹ 4,50,000

(iii) Loss from other speculative business: ₹ 13,00,000

(iv) Salary income: ₹ 10,00,000 (Computed)

(v) Short-term capital loss on sale of depreciable assets: ₹ 3,60,000

(vi) Long-term capital gain on sale of residential building: ₹ 1,30,000

(vii) Lottery income (Gross): ₹ 55,000

(viii) Brought forward business loss: ₹ 33,000 (this loss relates to Assessment Year 2021-22. This business was discontinued on 31.03.2022.)

You are required to compute the total income of Mr. Sumeet for the Assessment Year 2024-25 assuming he has opted for the default tax regime under section 115BAC of the Income Tax Act, 1961.

Also specify the amount of losses to be carried forward and up to which assessment year, if any.

Answer :

Question 5 (b)

Mr. Ram, a resident individual, aged 46 years, owns 2 residential house properties of which, one is used for own residential purpose and the other is let out for a monthly rent of ₹ 65,000. He bought these houses by taking housing loan from a nationalized bank. During the financial year 2023-24, he paid interest on housing loan of ₹ 2,10,000 each for both houses and total principal repayment of ₹ 2,50,000 for each house.

Mr. Ram is Doing iron business by name M/s Ram Enterprises in which his income (Computed) amount to ₹ 9,60,000

You are required to calculate total taxable income and tax liability of Mr. Ram for the Assessment Year 2024-25 under the default tax regime under section 115BAC of the Income Tax Act, 1961 and also optional tax regime as per the Regular provisions (old regime) of the Income Tax Act, 1961.

Advise Mr. Ram whether he should pay tax under default tax regime under section 115BAC of the Income Tax Act, 1961 or Regular provisions (old regime) of the Income Tax Act, 1961 for the assessment year 2024-25.

Answer :

Question 6 (a)

Explain the concept and features of indirect taxation.

Answer :

Concept of Indirect Taxation:

Features of Indirect Taxation:

Question 6 (b)

What are the benefits of the GST Council? State any five recommendations that can be made by the GST Council.

Answer :

Benefits of the GST Council

The GST Council, established under Article 279A of the Constitution, is the apex decision-making body for the Goods and Services Tax (GST). It ensures the smooth implementation and evolution of GST across India, fostering cooperative federalism. Below are the key benefits of the GST Council:

Five Recommendations That Can Be Made by the GST Council

Question 7 (a)

State, with reason, the person liable to pay GST in each of the following independent cases, where the supplier and recipient are located in the taxable territory. Ignore the aggregate turnover and exemption available, if any:

(i) Money Save Bank Ltd. located in Kolkata, appointed Ms. Sakshi as a recovery agent for collecting outstanding balance amount of loan from its customers. Ms. Sakshi provided service to Money Save Bank Ltd. for which she has raised a bill of ₹ 15,000.

(ii) Whether your answer will change in case of (i), if Ms. Sakshi provided recovery agent services to a car dealer company instead of Money Save Bank Ltd.

(iii) Mr. Mohit has taken a loan from Diwakar Bank Ltd. and for this he has taken a service of an individual Mr. Prakash who is a Direct Selling Agent of Diwakar Bank Ltd. and has paid the commission to Mr. Prakash for giving a customer to the bank @ 1% loan granted to Mr. Mohit.

Answer :

(i) Recovery agent services provided to a bank

Scenario: Ms. Sakshi, a recovery agent, provides services to Money Save Bank Ltd.

Analysis:

Conclusion:

(ii) Recovery agent services provided to a car dealer

Scenario: Ms. Sakshi provides recovery agent services to a car dealer company instead of a bank.

Analysis:

Conclusion:

(iii) Commission paid to a Direct Selling Agent (DSA)

Scenario: Mr. Prakash, an individual Direct Selling Agent, provides services to Diwakar Bank Ltd. and earns commission for bringing a customer to the bank.

Analysis:

Conclusion:

Question 7 (b)

Self & Life Insurance Company has collected premium from policy subscribers It does not maintain a separate allocation for investment of subscribers of the policy of the policy at the time of supply of insurance services. The company has provided the following details in relation to its receipts for the month of May, 2024:

(i) Renewal policyholders: Premiums collected ₹ 50,00,000

(ii) New policyholders: Premiums collected ₹ 75,00,000

(iii) Group Risk Cover policies: Premiums collected ₹ 30,00,000

(iv) Single premium annuity policies: Premiums collected ₹ 95,00,000

(v) Life micro-insurance policies as approved by the Insurance Regulatory and Development Authority, where amount insured does not exceed ₹ 2,00,000: Premiums collected ₹ 10,00,000

All amounts are exclusive of tax. You are required to compute the value of taxable supply of service by Self & Family Life Insurance Company in terms of rule 32(4) of the CGST Rules, 2017 by giving necessary explanations for treatment of various items.

Answer :

Question 8 (a)

Shyam Ltd. is a registered manufacturer of cars. Shyam Ltd. provides the following information of GST paid on the purchases made/input services availed by it during the month of May, 2024:

|

S.No. |

Particulars |

GST paid (₹) |

|

(i) |

Routine maintenance charges of cars manufactured by Shyam Ltd. |

40,500 |

|

(ii) |

Capital goods (out of five items, invoice for one item was missing and GST paid on that item was ₹ 2,500) |

45,000 |

|

(iii) |

Inputs consisting of four equal lots, out of which three lots were received during the month of May, 2024. |

65,000 |

|

(iv) |

Travel benefits extended to employees on vacation under statutory obligation |

7,500 |

|

(v) |

Purchased machinery for manufacturing process worth ₹ 2,00,000 and claimed depreciation under the Income Tax Act, 1961 on ₹ 2,36,000. |

36,000 |

|

(vi) |

Repairs services for office building, cost of repairs is charged to Profit and Loss Account |

48,000 |

Determine the amount of Input tax credit (ITC) available with Shyam Ltd. for the month of May, 2024 by giving necessary explanations for treatment of various items. All the conditions necessary for availing the input tax credit except mentioned above have been fulfilled.

Answer :

ITC Computation for Shyam Ltd. for May 2024

Total Input Tax Credit (ITC) Available: ₹83,000

Computation Table

| S. No. | Particulars | GST Paid (₹) | Eligibility for ITC | Reason |

| (i) | Routine maintenance charges of cars manufactured | 40,500 | Eligible | Routine maintenance is directly related to manufacturing, eligible under Section 16(1). |

| (ii) | Capital goods (one invoice missing; GST for that ₹2,500) | 45,000 | ₹42,500 Eligible | ITC cannot be claimed without a valid tax invoice as per Section 16(2) for ₹2,500; balance is eligible. |

| (iii) | Inputs (one lot pending out of four) | 65,000 | Not Eligible | ITC is deferred as per First Proviso to Section 16(2); allowed only upon receipt of the last lot. |

| (iv) | Travel benefits extended to employees on vacation | 7,500 | Not Eligible | ITC on employee travel benefits is blocked under Section 17(5). |

| (v) | Machinery purchased for manufacturing process | 36,000 | Not Eligible | ITC is disallowed as depreciation is claimed on GST component under Section 17(5). |

| (vi) | Repairs services for office building | 48,000 | Not Eligible | ITC on repairs for immovable property is blocked under Section 17(5)(d). |

Explanation for ITC on Inputs

As per the First Proviso to Section 16(2), ITC for goods received in lots can only be claimed upon the receipt of the last lot. In this case, one lot out of four is pending, so the ITC of ₹65,000 is not available for May 2024.

Revised Final Computation of Total Eligible ITC

| Particulars | Amount (₹) |

| Routine maintenance charges | 40,500 |

| Capital goods (excluding missing invoice) | 42,500 |

| Inputs (deferred due to pending lot) | 0 |

| Total Eligible ITC | 83,000 |

Question 8 (b)

Palak Trade Ltd. of Mumbai has imported a machine by air from UK. The details in this regard are as under:

|

S.No. |

Particulars |

Amount |

|

(i) |

Price of the Machine |

UK Pound 10,000 |

|

(ii) |

Air freight, loading, unloading & handling charges associated with the delivery of the imported goods to the place of importation |

UK Pound 2,000 |

|

(iii) |

Royalties relating to imported machine payable by buyer as condition of sale |

UK Pound 500 |

|

(iv) |

Design and engineering charges paid to Consultancy firm in UK |

UK Pound 300 |

|

(v) |

Insurance charges paid to the place of importation |

Not known |

Other Information

|

Date of bill of entry |

30-04-2024 (Rate of BCD 10%; Exchange rate as notified by CBIC ₹ 104 per UK Pound) |

|

Date of arrival of aircraft |

21-05-2024 (Rate of BCD 20%; Exchange rate as notified by CBIC ₹ 103 per UK Pound) |

|

Social Welfare Surcharge (SWS) |

10% |

|

Integrated tax payable u/s 3(7) of the Customs Tariff Act, 1975 |

12% |

|

Ignore GST compensation cess and Agriculture infrastructure and development cess |

|

You are required to compute the total customs duties and integrated tax payable by Palak Trade Ltd. under the Customs Act, 1962 with appropriate working notes from the above information.

Relevant legal reasoning should form part of your answer.

Answer :

Computation of Customs Duties and Integrated Tax Payable

Step 1: FOB and CIF Values

Step 2: Basic Customs Duty (BCD)

The rate of BCD is 20% based on the arrival date of the aircraft (21-05-2024).

BCD Amount = 20% of ₹13,43,836 = ₹2,68,767

Step 3: Social Welfare Surcharge (SWS)

SWS is calculated at 10% of BCD.

SWS = 10% of ₹2,68,767 = ₹26,877

Step 4: Value for Integrated Tax (IGST)

The value for IGST includes CIF Value, BCD, and SWS.

Value for IGST = ₹13,43,836 + ₹2,68,767 + ₹26,877 = ₹16,39,480

Step 5: Integrated Tax Payable (IGST)

IGST is levied at 12% on the value for IGST.

IGST = 12% of ₹16,39,480 = ₹1,96,738

Step 6: Total Customs Duties and Taxes Payable

| Component | Amount (₹) |

| Basic Customs Duty (BCD) | 2,68,767 |

| Social Welfare Surcharge (SWS) | 26,877 |

| Integrated Tax (IGST) | 1,96,738 |

| Total Payable | 4,92,382 |

Legal Reasoning

Final Answer: Total Customs Duties and Taxes Payable = ₹4,92,382

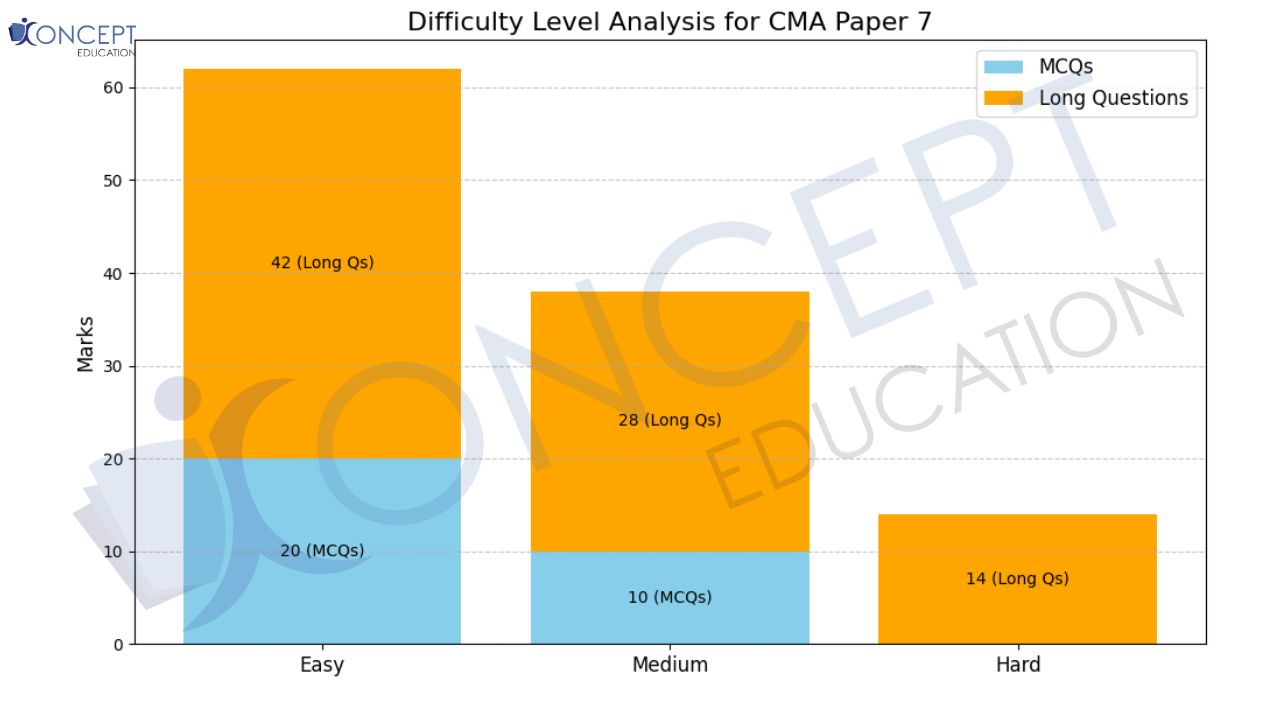

Direct and Indirect Taxation detailed analysis

This analysis categorizes the questions in the CMA Intermediate Paper 7 into three levels of difficulty: Easy, Medium, and Hard. Questions are marked "Easy" if they are directly based on ICMAI study material or past papers. "Medium" questions require intermediate-level application, while "Hard" questions involve complex, multi-step analysis.

| Question No. | Topic | Difficulty Level | Reasoning |

| (i) | Clubbing of Income | Easy | Matches study material example on clubbing of a minor’s income (Sec 64). |

| (ii) | Deduction of Partner’s Remuneration | Easy | Directly matches study material on Sec 40(b) regarding limits on deductions. |

| (iii) | Agricultural Income | Easy | Based on clear definition in Sec 2(1A); standard study material question. |

| (iv) | Exemption under Sec 54 | Easy | Covered in detail in study material; directly matches examples. |

| (v) | Depreciation on Laptop | Medium | Requires application of Sec 43(1) and calculation of depreciation. |

| (vi) | TDS on Cash Withdrawals | Medium | Requires understanding of Sec 194N and handling of thresholds. |

| (vii) | GST Exemptions on Religious Places | Easy | Matches GST exemptions in the study material. |

| (viii) | GST Liability for ECO | Easy | Standard scenario for Section 9(5) of CGST Act; matches examples. |

| (ix) | Taxability under Excise and GST | Easy | Matches examples in GST-excluded items (study material). |

| (x) | Tax Invoice Requirements | Medium | Requires recall of Rule 46 details for goods vs services. |

| (xi) | Identical Goods under Customs Act | Easy | Matches definition of identical goods under Customs Valuation Rules. |

| (xii) | Composition Scheme Threshold for Services | Easy | Directly matches Sec 10(2A); explained in study material. |

| (xiii) | GST on Employer Gifts | Medium | Requires recall of GST rules for gifts exceeding ₹50,000. |

| (xiv) | Definition of Indian Customs Waters | Medium | Requires application of Sec 2(28) of Customs Act, 1962. |

| (xv) | Exceeding Turnover under Composition Scheme | Medium | Requires understanding of withdrawal of composition scheme upon threshold breach. |

| Question No. | Topic | Difficulty Level | Reasoning |

| Q2(a) | Capital/Revenue Classification | Medium | Multi-step analysis required for classification; partially standard. |

| Q2(b) | Gratuity, Leave Salary, and Pension Calculations | Easy | Matches standard study material examples; straightforward calculation. |

| Q3(a) | Income from House Property | Medium | Requires application of Sec 23, includes vacant months and deductions. |

| Q3(b) | P&L Adjustments for Partnership Firm | Medium | Multi-step process involving depreciation, TDS, and partnership deed rules. |

| Q4(a) | Long-Term Capital Gains | Medium | Requires calculation with CII and Sec 54EC exemption; moderately standard. |

| Q4(b) | Income from Other Sources | Easy | Matches study material examples for gifts, dividends, and deductions. |

| Q5(a) | Loss Set-Off Rules | Medium | Involves multiple heads and requires detailed understanding of carry-forward rules. |

| Q5(b) | Tax Computation (Old vs New Regime) | Hard | Complex comparison of tax liability under Sec 115BAC and old provisions. |

| Q6(a) | Concept and Features of Indirect Taxes | Easy | Straightforward theoretical question; matches study material. |

| Q6(b) | GST Council Benefits and Recommendations | Easy | Directly covered in GST study material. |

| Q7(a) | Reverse Charge Mechanism | Medium | Requires identifying GST liability in multiple scenarios. |

| Q7(b) | Value of Taxable Supply for Insurance Policies | Medium | Requires detailed calculations as per CGST Rule 32(4); moderately complex. |

| Difficulty Level | MCQs (Marks) | Long Questions (Marks) | Total Marks | Percentage |

| Easy | 20 | 42 | 62 | 53% |

| Medium | 10 | 28 | 38 | 33% |

| Hard | 0 | 14 | 14 | 14% |

This analysis reveals that 53% of the paper is easy, making it accessible to students who have studied the ICMAI material thoroughly. Medium and hard questions account for 33% and 14% respectively, emphasizing the importance of a balanced preparation strategy.

Ruchika Ma'am has been a meritorious student throughout her student life. She is one of those who did not study from exam point of view or out of fear but because of the fact that she JUST LOVED STUDYING. When she says - love what you study, it has a deeper meaning.

She believes - "When you study, you get wise, you obtain knowledge. A knowledge that helps you in real life, in solving problems, finding opportunities. Implement what you study". She has a huge affinity for the Law Subject in particular and always encourages student to - "STUDY FROM THE BARE ACT, MAKE YOUR OWN INTERPRETATIONS". A rare practice that you will find in her video lectures as well.

She specializes in theory subjects - Law and Auditing.

Yash Sir (As students call him fondly) is not a teacher per se. He is a story teller who specializes in simplifying things, connecting the dots and building a story behind everything he teaches. A firm believer of Real Teaching, according to him - "Real Teaching is not teaching standard methods but giving the power to students to develop his own methods".

He cleared his CA Finals in May 2011 and has been into teaching since. He started teaching CA, CS, 11th, 12th, B.Com, M.Com students in an offline mode until 2016 when Konceptca was launched. One of the pioneers in Online Education, he believes in providing a learning experience which is NEAT, SMOOTH and AFFORDABLE.

He specializes in practical subjects – Accounting, Costing, Taxation, Financial Management. With over 12 years of teaching experience (Online as well as Offline), he SURELY KNOWS IT ALL.