CA Inter Jan 25 Suggested Answers | Advanced Accounting

Looking for solutions to the CA Inter Jan 25 Suggested Answers for Advanced Accounting ? You’re in the right place! This blog covers everything you need to know about the CA Inter January 2025 Exam, including detailed solutions and insights to help you excel. We’re here to provide a comprehensive breakdown of the January 2025 Advanced Accounting Paper.

Table of Content

CA Inter Jan 25 Suggested Answer Other Subjects Blogs :

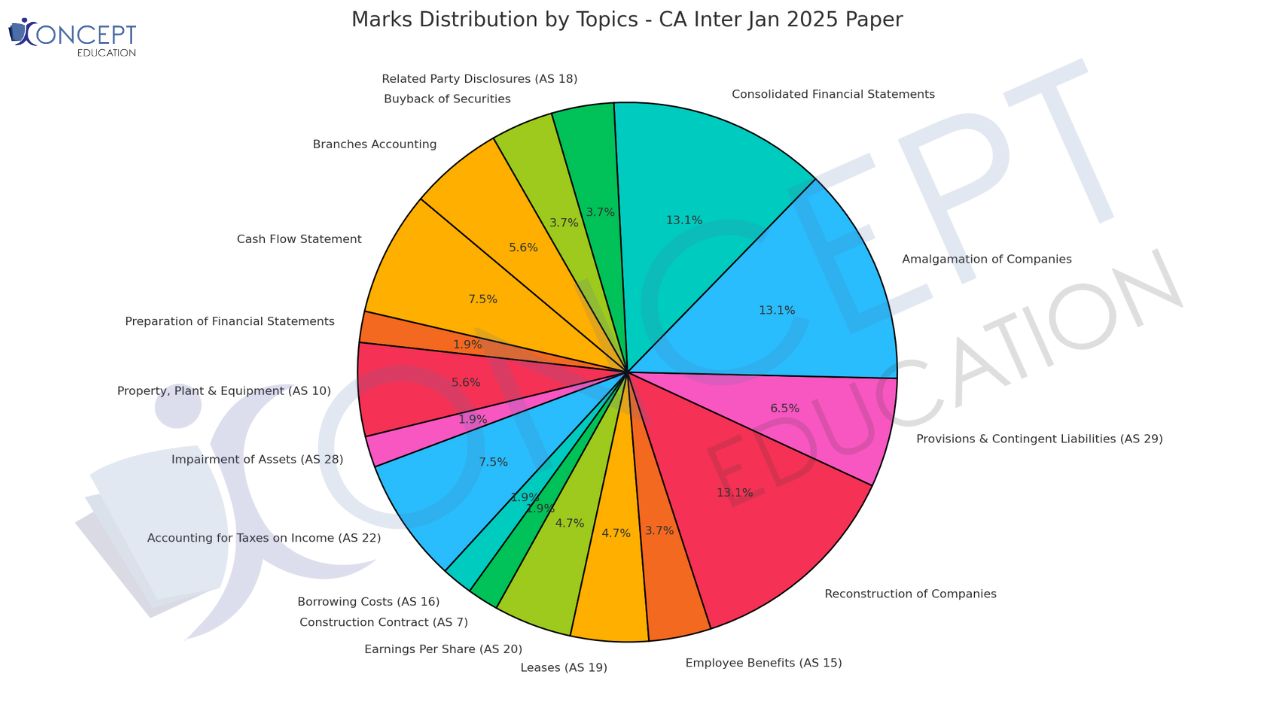

CA Inter Paper Analysis

Question 1 (A) :

XYZ Limited has provided you the following information as on 31st March, 2024:

|

Particulars |

₹ |

|

Net profit (After Tax) |

₹31,20,000 |

|

No. of shares outstanding as on 31-3-2024 of ₹ 10 each |

8,00,000 |

|

Average fair value of one equity share during the year 2023-24 |

₹25 |

|

Weighted average no. of shares under option during the year 2023-24 |

80,000 |

|

Exercise price for shares under option during the year 2023-24 |

₹20 |

|

12% Debentures of ₹ 100 each (Each debenture is convertible into 4 equity shares) |

₹30,00,000 |

|

Tax rate |

30% |

The company issued one equity share as bonus for every 5 equity shares outstanding as on 1st October, 2023. It further issued 2,00,000 equity shares of ₹ 10 each as on 1st January, 2024. Financial Year of the company ends on 31st March each year.

You are required to calculate Basic and Diluted earnings per share as on 31st March, 2024 (round off your answer to 2 decimal places).

Answer:

EPS Calculation

Understanding the Shares Outstanding

Shares as on 31st March 2024 (Closing): 8,00,000 shares (includes all bonus shares and fresh issue).

Fresh issue on 1st January 2024: Fresh shares issued = 2,00,000.

Shares outstanding as of 31st December 2023 (before fresh issue) = 6,00,000.

Bonus issue on 1st October 2023: 1 share for every 5 shares.

Pre-bonus shares = 5,00,000.

Weighted Average Shares Calculation

| Period | Shares Outstanding | Weight | Weighted Shares |

| 1st April 2023 to 31st December 2023 (9 months) (as bonus is considered to be issued on 1st day) | 6,00,000 | 9/12 | 4,50,000 |

| 1st January 2024 to 31st March 2024 (3 months) | 8,00,000 | 3/12 | 2,00,000 |

| Total | 6,50,000 | ||

Basic EPS Calculation

Net Profit After Tax: ₹31,20,000.

Weighted Average Shares: 6,50,000.

Basic EPS: ₹31,20,000 / 6,50,000 = ₹4.80.

Adjustments for Diluted EPS

Net Profit Adjustment for Convertible Debentures:

Interest saved = ₹3,60,000.

Tax on interest = ₹1,08,000.

Adjusted Net Profit = ₹31,20,000 + ₹3,60,000 - ₹1,08,000 = ₹33,72,000.

Additional Shares:

Convertible Debentures = 30,000*4 = 1,20,000 shares.

Options : Incremental shares = 80,000 less 80000*20/25 = 16,000.

Total Adjusted Weighted Shares = 6,50,000 + 1,20,000 + 16,000 = 7,86,000.

Diluted EPS Calculation

Diluted EPS: ₹33,72,000 / 7,86,000 = ₹4.29.

Final Answer

Basic EPS: ₹4.80

Diluted EPS: ₹4.29

Question 1 (B) :

J Limited availed an equipment on lease from K Limited. The conditions of the lease terms are as under:

State whether this lease is Operating lease or Finance lease (by applying two deterministic parameters). Also calculate unearned finance income.

Answer:

Question 1 (C) :

What is the difference between Defined Contribution Plan and Defined Benefit Plan? From the following information calculate the amount of defined benefit liability/asset:

|

Particulars |

₹ in lakhs |

|

Present Value of Defined Benefit Obligation as on 31-3-2024 |

36.0 |

|

Fair Value of Plan asset |

38.5 |

|

Past service cost not yet recognized |

7.5 |

|

Present value of available future refund from the plan |

6.0 |

Answer:

Difference Between Defined Contribution Plan and Defined Benefit Plan

Defined Contribution Plan (DCP):

Defined Benefit Plan (DBP):

Accounting: Detailed actuarial calculations are performed to determine the charge.

Recognition of Defined Benefit Liability/Asset

Formula for Recognition in the Balance Sheet

The amount recognized as a defined benefit liability or asset should be the net total of the following amounts:

Calculation Based on Provided Data

| Particulars | ₹ in Lakhs |

|---|---|

| Present Value of Defined Benefit Obligation (PVDBO) | 36.0 |

| Past Service Cost Not Yet Recognized | 7.5 |

| Fair Value of Plan Assets | 38.5 |

| Present Value of Available Future Refund | 6.0 |

Net Defined Benefit Liability/Asset

Using the formula:

Net Defined Benefit Liability/Asset = PVDBO - Past Service Cost Not Yet Recognized - Fair Value of Plan Assets

Substitute the values:

Net Defined Benefit Liability/Asset = 36.0 - 7.5 - 38.5 = -10.0 (Asset)

Adjustment for Future Refund

The Present Value of Available Future Refund is ₹6.0 lakhs. This means the overfunded amount of ₹10.0 lakhs should be limited to the refund available from the plan.

Rule under AS 15

As per AS 15, when the net defined benefit amount results in an asset (i.e., overfunded), the amount recognized as a defined benefit asset should not exceed the present value of available future refunds or reductions in future contributions to the plan. This ensures that only realizable benefits are reflected in the Balance Sheet.

Final Recognition

Defined Benefit Asset to Be Recognized: The net defined benefit asset is limited to ₹6.0 lakhs, as the refund available restricts recognition.

Balance Sheet Disclosure: The enterprise should recognize ₹6.0 lakhs as a Defined Benefit Asset in its Balance Sheet.

Question 2 :

Sustain Limited is incurring losses due to adverse market conditions. It decided to reorganize its capital structure. The summarized Balance Sheet of the company as on 31st March, 2024 is as follows:

|

Particulars |

||

|

Equity and Liabilities |

Notes |

₹ |

|

1. Shareholders' Fund |

|

|

|

(a) Share Capital |

1 |

10,00,000 |

|

(b) Reserves and Surplus |

2 |

(2,50,000) |

|

2. Non-current liabilities |

|

|

|

Long-term borrowings |

3 |

4,50,000 |

|

3. Current liabilities |

|

|

|

(a) Trade Payables |

|

1,30,000 |

|

(b) Short term borrowings – Bank Overdraft |

|

65,000 |

|

(c) Other Current Liabilities (Interest payable on Debentures) |

|

45,000 |

|

(d) Short term provision (Provision for Income Tax) |

|

1,00,000 |

|

Total |

15,40,000 |

|

|

Assets |

|

|

|

1. Non-current assets |

|

|

|

(a) Property, Plant & Equipment |

4 |

8,50,000 |

|

(b) Intangible assets |

5 |

60,000 |

|

(c) Non-current investments |

6 |

2,80,000 |

|

2. Current assets |

|

|

|

(a) Inventories |

|

1,20,000 |

|

(b) Trade Receivables |

|

2,30,000 |

|

Total |

15,40,000 |

|

Notes to accounts

|

₹ |

|

|

1. Share Capital |

|

|

Equity share capital : |

|

|

50,000 Equity shares of ₹ 10 each fully paid up |

5,00,000 |

|

25,000 Equity shares of ₹ 10 each, ₹ 8 paid up |

2,00,000 |

|

Preference share capital : |

|

|

30,000 8% Cumulative Preference shares of ₹ 10 each (Preference dividend has been in arrears for 3 years) |

3,00,000 |

|

Total |

10,00,000 |

|

2. Reserves and Surplus |

|

|

Profit and Loss account (debit balance) |

(2,50,000) |

|

2,50,000 |

|

|

3. Long-term borrowings |

|

|

Secured: |

|

|

10% Debentures of ₹ 100 each |

4,50,000 |

|

4,50,000 |

|

|

4. Property, Plant and Equipment |

|

|

Freehold property |

1,00,000 |

|

Plant and machinery |

7,50,000 |

|

Total |

8,50,000 |

|

5. Intangible assets |

|

|

Goodwill |

60,000 |

|

60,000 |

|

|

6. Non-current investments |

|

|

Non-trade investments at cost |

2,80,000 |

|

2,80,000 |

Subsequent to approval by court and all interested parties, the following scheme of reconstruction were agreed:

You are required to:

(a) Show the journal entries, necessary to record the above transaction in the company’s books and

(b) Prepare a note to show revised Share capital structure of the company after completion of the scheme.

Answer:

Question 3 (A) :

An Engineering goods company provides "after sales warranty" for 2 years to its customers. Based on the past experience, the company has been following policy for making provision for warranties on the Invoice amount on the remaining balance warranty period:

The Company has raised Invoices as under:

|

Invoice Date |

₹ |

|

20th February, 2021 |

42,000 |

|

17th July, 2021 |

25,000 |

|

27th January, 2022 |

47,000 |

|

1st March, 2023 |

1,10,000 |

|

24th August, 2023 |

34,000 |

|

20th March, 2024 |

75,000 |

You are required to:

Answer:

The warranty provision is calculated based on the remaining warranty period for each invoice:

The remaining warranty period is calculated by comparing the invoice date to the current date (e.g., 31st March 2023 or 31st March 2024).

| Invoice Date | Invoice Amount (₹) | Warranty Period Remaining | Applicable Rate | Provision (₹) |

|---|---|---|---|---|

| 20th February, 2021 | 42,000 | Expired (> 2 years) | No provision | 0 |

| 17th July, 2021 | 25,000 | < 1 year remaining | 2.5% | 625 |

| 27th January, 2022 | 47,000 | < 1 year remaining | 2.5% | 1,175 |

| 1st March, 2023 | 1,10,000 | > 1 year remaining | 4.5% | 4,950 |

| Total Provision as of 31-03-2023 | 6,750 | |||

| Invoice Date | Invoice Amount (₹) | Warranty Period Remaining | Applicable Rate | Provision (₹) |

|---|---|---|---|---|

| 20th February, 2021 | 42,000 | Expired (> 2 years) | No provision | 0 |

| 17th July, 2021 | 25,000 | Expired (> 2 years) | No provision | 0 |

| 27th January, 2022 | 47,000 | Expired (> 2 years) | No provision | 0 |

| 1st March, 2023 | 1,10,000 | < 1 year remaining | 2.5% | 2,750 |

| 24th August, 2023 | 34,000 | > 1 year remaining | 4.5% | 1,530 |

| 20th March, 2024 | 75,000 | > 1 year remaining | 4.5% | 3,375 |

| Total Provision as of 31-03-2024 | 7,655 | |||

The amount debited to the Profit and Loss Account is the increase in provision during the year:

Increase in Provision = Provision as of 31-03-2024 - Provision as of 31-03-2023

Increase in Provision = ₹7,655 - ₹6,750 = ₹905.

Question 3 (B) :

Given below are the extracts of the Balance Sheet of BGH Limited:

|

Particulars |

31st March, 2024 (₹) |

31st March, 2023 (₹) |

|

Share Capital |

5,00,000 |

4,00,000 |

|

Profit & Loss Account |

1,10,000 |

60,000 |

|

10% Debentures (issued at the end of the year) |

1,00,000 |

- |

|

Bank Loan |

2,50,000 |

2,00,000 |

|

Trade Payable |

60,000 |

75,000 |

|

Dividend Payable |

- |

50,000 |

|

Interest Payable on Bank Loan (Current Year) |

25,000 |

20,000 |

|

Goodwill |

1,20,000 |

1,50,000 |

|

Trade Receivables |

65,000 |

95,000 |

|

Inventory |

55,000 |

30,000 |

You are required to prepare for the year ended 31st March, 2024:

Answer:

| Particulars | Amount (₹) |

|---|---|

| Net Profit before Working Capital Changes | 50,000 |

| Adjustments for Non-Cash/Non-Operating Items: | |

| Amortization of Goodwill | 30,000 |

| Working Capital Adjustments: | |

| Decrease in Trade Receivables | 30,000 |

| Increase in Inventory | (25,000) |

| Decrease in Trade Payables | (15,000) |

| Increase in Interest Payable | 25,000 |

| Less: Dividend Paid (Previous Year's Dividend Payable) | (50,000) |

| Net Cash Flow from Operating Activities | 45,000 |

| Particulars | Amount (₹) |

|---|---|

| Proceeds from Issue of Share Capital | 1,00,000 |

| Proceeds from Issue of Debentures | 1,00,000 |

| Increase in Bank Loan | 50,000 |

| Less: Interest Paid (on Bank Loan) | (20,000) |

| Net Cash Flow from Financing Activities | 2,30,000 |

| Particulars | Amount (₹) |

|---|---|

| A. Cash Flow from Operating Activities | 45,000 |

| B. Cash Flow from Financing Activities | 2,30,000 |

| Net Increase in Cash | 2,75,000 |

Note : The interest paid (₹20,000) is classified under financing cash flows, adhering to AS-3 guidelines for non-financial enterprises.

Question 4 :

Following are the summarized Balance Sheets of Light Limited and Bright Limited as at 31st March, 2024:

|

Particulars |

Notes |

Light Limited (₹ in Lakhs) |

Bright Limited (₹ in Lakhs) |

|

Equity and Liabilities |

|||

|

Shareholders' Funds |

|

|

|

|

(a) Share Capital |

1 |

50.00 |

40.00 |

|

(b) Reserves and Surplus |

2 |

27.00 |

24.00 |

|

Non-Current Liabilities |

|

|

|

|

Long Term Provisions |

|

1.50 |

- |

|

Current Liabilities |

|

|

|

|

Trade Payables |

|

3.40 |

2.00 |

|

Total |

81.90 |

66.00 |

|

|

Assets |

|||

|

Non-Current Assets |

|

|

|

|

Property, Plant and Equipment |

3 |

68.70 |

50.25 |

|

Current Assets |

|

|

|

|

(a) Inventories |

|

5.75 |

7.10 |

|

(b) Trade Receivables |

|

4.30 |

5.80 |

|

(c) Cash and Cash equivalents |

|

3.15 |

2.85 |

|

Total |

81.90 |

66.00 |

Notes to Accounts:

|

Particulars |

Light Limited (₹ in Lakhs) |

Bright Limited (₹ in Lakhs) |

|

1. Share Capital |

||

|

50,000 Equity Shares of ₹ 100 each |

50.00 |

40.00 |

|

2. Reserves and Surplus |

||

|

Statutory Reserve |

2.00 |

- |

|

General Reserve |

18.00 |

15.00 |

|

Securities Premium |

- |

5.00 |

|

Profit and Loss |

7.00 |

4.00 |

|

27.00 |

24.00 |

|

|

3. Property, Plant and Equipment |

||

|

Land and Building |

58.00 |

44.00 |

|

Plant and Machinery |

7.50 |

4.50 |

|

Other Assets |

3.20 |

1.75 |

|

68.70 |

50.25 |

Other Information:

You are required to Prepare:

Answer:

Question 5 :

The summarised Balance Sheets of Super Limited and Clear Limited as on 31st March, 2024 is as below:

|

Particulars |

Note |

Super Limited (₹) |

Clear Limited (₹) |

|

Equity and Liabilities |

|||

|

Shareholders' Funds |

|

|

|

|

Share Capital |

1 |

95,00,000 |

50,00,000 |

|

Reserves and Surplus |

2 |

25,75,000 |

12,25,000 |

|

Non-Current Liabilities |

|

|

|

|

Long term borrowings |

3 |

5,00,000 |

2,00,000 |

|

Current Liabilities |

|

|

|

|

Short term borrowings |

|

4,50,000 |

- |

|

Trade Payables |

|

3,65,000 |

2,45,000 |

|

Total |

1,33,90,000 |

66,70,000 |

|

|

Assets |

|||

|

Non-current assets |

|

|

|

|

Property, Plant and Equipment |

4 |

77,00,000 |

54,00,000 |

|

Non-Current investment |

5 |

41,50,000 |

- |

|

Current Assets |

|

|

|

|

(a) Inventories |

|

6,75,000 |

5,65,000 |

|

(b) Trade Receivables |

|

5,85,000 |

4,90,000 |

|

(c) Cash and Cash equivalents |

|

2,80,000 |

2,15,000 |

|

Total |

1,33,90,000 |

66,70,000 |

Notes to Accounts:

|

Particulars |

Super Limited (₹) |

Clear Limited (₹) |

|

1. Share Capital |

||

|

8,00,000 Equity Shares of ₹ 10 each fully paid up |

80,00,000 |

- |

|

5,00,000 Equity Shares of ₹ 10 each fully paid up |

- |

50,00,000 |

|

15,000 Preference Shares of ₹ 100 each fully paid up |

15,00,000 |

- |

|

95,00,000 |

50,00,000 |

|

|

2. Reserves and Surplus |

||

|

General Reserve |

15,50,000 |

6,50,000 |

|

Profit and Loss Account |

10,25,000 |

5,75,000 |

|

25,75,000 |

12,25,000 |

|

|

3. Long term borrowings |

|

|

|

10% Debentures |

5,00,000 |

-- |

|

9% Debentures |

- |

2,00,000 |

|

4. Property, Plant & Equipment |

||

|

Land & Building |

65,00,000 |

45,50,000 |

|

Plant & Machinery |

9,50,000 |

6,75,000 |

|

Furniture & Fittings |

2,50,000 |

1,75,000 |

|

77,00,000 |

54,00,000 |

|

|

5. Non-Current Investment |

||

|

Investment in Clear Limited |

41,50,000 |

- |

Additional Information:

Super Limited holds 75% of Equity Shares in Clear Limited since the incorporation of Clear Limited.

You are required to prepare Consolidated Balance Sheet of Super Limited and Clear Limited as on 31st March, 2024.

Answer:

Question 6 (A):

The following information is provided for the year ended 31st March, 2024:

(i) AX Limited holds 70% shares of BX Limited

(ii) BX Limited holds 30% shares of CX Limited

(iii) DX Limited holds 40% shares in CX Limited

(iv) DX Limited holds 49% shares in EX Limited

You are required to:

(i) Identify the related parties for the reporting entities – AX Limited, CX Limited, and EX Limited.

(ii) If DX Limited would have sold its investment in EX Limited on 1st October, 2023, but goods were continued to be supplied by DX Limited to EX Limited throughout the year, will this scenario change your answer with respect to any of the reporting entity mentioned in point (i)?

Give reasons for your answer as per AS 18.

Answer:

OR

Question 6 (A):

Given below is the balance sheet of Sky and Associates as on 31st March 2023 :

|

Liabilities |

₹ |

Assets |

₹ |

|

Capital |

1,60,000 |

Machinery |

1,80,000 |

|

Profit & Loss Account |

93,000 |

Stock |

1,15,000 |

|

8% Loan |

40,000 |

Trade Receivables |

75,000 |

|

Trade Payables |

66,000 |

Deferred Expenditure |

9,000 |

|

Bank Overdraft |

20,000 |

|

|

|

Total |

3,79,000 |

Total |

3,79,000 |

Additional Information:

You are required to prepare a Profit & Loss A/c for the year ended 31st March, 2024 to ascertain its Profit/Loss for the period.

Answer:

Question 6 (B):

Following information are available in respect of Z Limited as on 31st March, 2024:

The company decides to buy back 20% of its Equity capital @ ₹ 15 per share on 1st April, 2024. Buy back is as per provisions of the Companies Act and company passed the necessary resolutions for it. For this purpose, it sold its investments of ₹ 40 lakhs for ₹ 32 lakhs.

You are required to pass the necessary journal entries.

Answer:

Question 6 (C):

Give Journal Entries (with Narrations) in the books of an Independent Branch of a business entity to rectify or adjust the following:

(i) Commission (income) of ₹ 7,500 allocated to Branch by Head office but still no entry is passed in the books of Branch.

(ii) Head office paid ₹ 12,000 directly to one of Branch’s suppliers. The intimation is received by Branch on reconciliation of bank statement of Branch with its books.

(iii) A remittance of ₹ 85,000 is sent by Branch to Head office has not been received by Head office till date.

(iv) Branch paid ₹ 9,800 as salary to Head office’s employee, but the amount paid has been wrongly debited to salary account.

(v) Branch purchased Furniture for ₹ 18,000 through cheque, but the Furniture account was retained in Head Office Books. No entry has yet been passed.

(vi) Branch incurred ₹ 5,500 of expenses on behalf of other Branches of Head office, this transaction was not recorded in the books of Branch.

Answer:

Ruchika Ma'am has been a meritorious student throughout her student life. She is one of those who did not study from exam point of view or out of fear but because of the fact that she JUST LOVED STUDYING. When she says - love what you study, it has a deeper meaning.

She believes - "When you study, you get wise, you obtain knowledge. A knowledge that helps you in real life, in solving problems, finding opportunities. Implement what you study". She has a huge affinity for the Law Subject in particular and always encourages student to - "STUDY FROM THE BARE ACT, MAKE YOUR OWN INTERPRETATIONS". A rare practice that you will find in her video lectures as well.

She specializes in theory subjects - Law and Auditing.

Yash Sir (As students call him fondly) is not a teacher per se. He is a story teller who specializes in simplifying things, connecting the dots and building a story behind everything he teaches. A firm believer of Real Teaching, according to him - "Real Teaching is not teaching standard methods but giving the power to students to develop his own methods".

He cleared his CA Finals in May 2011 and has been into teaching since. He started teaching CA, CS, 11th, 12th, B.Com, M.Com students in an offline mode until 2016 when Konceptca was launched. One of the pioneers in Online Education, he believes in providing a learning experience which is NEAT, SMOOTH and AFFORDABLE.

He specializes in practical subjects – Accounting, Costing, Taxation, Financial Management. With over 12 years of teaching experience (Online as well as Offline), he SURELY KNOWS IT ALL.