CA Inter GST Amendments May 25

Table of Contents

Other Relevent Blogs

in relation to any goods or services or both, shall mean the person supplying the said goods or services or both and shall include an agent acting as such on behalf of such supplier in relation to the goods or services or both supplied.

However, a person who organises or arranges, directly or indirectly, supply of specified actionable claims, including a person who owns, operates or manages digital or electronic platform for such supply, shall be deemed to be a supplier of such actionable claims, whether such actionable claims are supplied by him or through him and whether consideration in money or money's worth, including virtual digital assets, for supply of such actionable claims is paid or conveyed to him or through him or placed at his disposal in any manner, and all the provisions of this Act shall apply to such supplier of specified actionable claims, as if he is the supplier liable to pay the tax in relation to the supply of such actionable claims [Section 2(105)].

Analysis

GST on Food & Beverages at Cinema Halls

| Scenario | GST Treatment | Applicable GST Rate |

| You buy food/beverages separately from a kiosk/stall/restaurant inside the cinema hall | Treated as Restaurant Service | ✅ 5% (No ITC) |

| Food/beverages are bundled with the cinema ticket as a combo (single price) | Treated as Composite Supply, with Cinema Exhibition as principal supply | 18% (on total combo) |

GST on Renting vs Passenger Transport Services – RCM Clarification

The circular clears confusion on whether Reverse Charge Mechanism (RCM) applies to:

Key Difference Between the Two Services

| Criteria | Renting of Motor Vehicle | Passenger Transport Services |

| Tariff Heading | Different Tariff heading from passenger transport | Separate tariff heading |

| Nature of Use | Vehicle is hired for a period of time, kept at disposal | Used for specific journey (fixed route & schedule) |

| Control & Customization | ✅ Renter controls routes, timings, usage | ❌ Fixed by service provider |

| Example | Company hires car for staff full day use, with full control | Bus transport on fixed route to pick & drop employees |

| RCM Applicable? | ✅ Yes (Body Corporate to pay GST under RCM) | ❌ No (RCM not applicable) |

➡️ GST to be paid by the Body Corporate under RCM

➡️ GST is paid by the service provider under forward charge, not by body corporate.

Example-Based Understanding

| Scenario | GST Under RCM? |

| Company rents a car for 8 hours daily to drop employees anywhere | ✅ Yes |

| Company books Ola/Uber or bus for a fixed route & timing | ❌ No |

| Monthly contract with vehicle provider with driver for office errands | ✅ Yes |

| Using shared cab service on per-trip basis | ❌ No |

✅ General Rule (as per RCM):

When a director provides services to the company in the capacity of a director,

➡️ GST is payable by the company under Reverse Charge Mechanism (RCM).

But what if the director provides services in his personal capacity?

This circular clarifies that:

❌ RCM is NOT applicable when a director supplies services in their personal/private capacity.

| Scenario | Director’s Capacity | GST under RCM? |

| Director attends board meetings, advisory roles, etc. | As Director | ✅ Yes (RCM applicable) |

| Director rents out personal property (e.g., flat/office space) to company | In Personal Capacity | ❌ No (RCM not applicable) |

| Director provides legal/consulting services under a personal business name | In Personal Capacity | ❌ No (RCM not applicable) |

| Director receives sitting fees or commissions from the company | As Director | ✅ Yes (RCM applicable) |

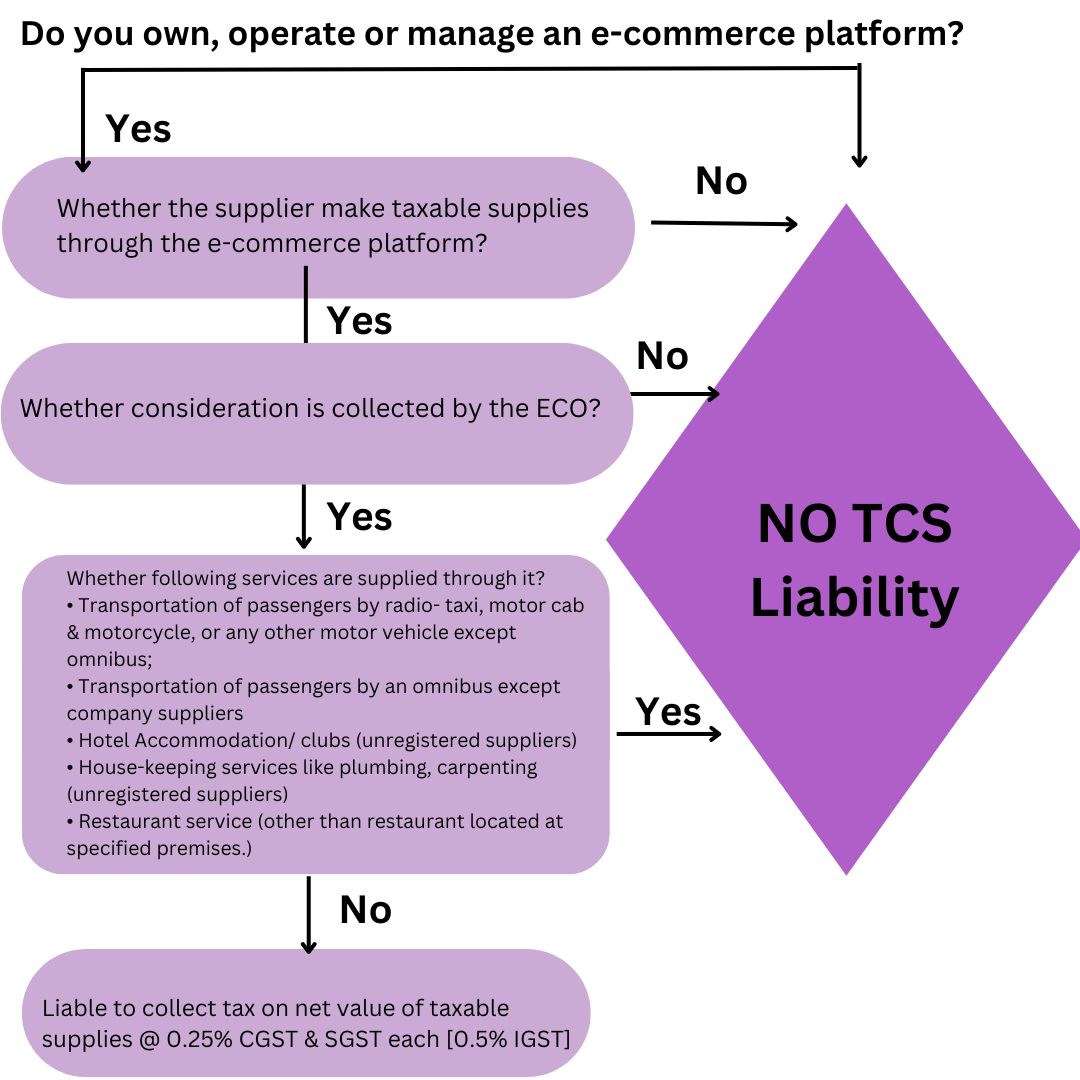

✅ An ECO is any person who owns, operates, or manages a digital/electronic platform through which goods or services or both are supplied.

| Scenario | Who Supplies? | Who Owns Platform? | Who Collects Payment? |

| 1. ECO supplies directly | ECO itself | ECO | ECO |

| 2. ECO enables supply by others | Actual seller/vendor | ECO | ECO (then passes on to seller after deducting commission) |

Example:

You order a product on an app like Amazon or a ride via Uber:

✅ Normal Rule:

The actual supplier (restaurant, driver, seller) pays GST

ECO only collects and passes payment after deducting commission (on which ECO pays GST)

Special Rule – Notified Services [Section 9(5)]:

The Government may notify certain services where: ? GST is to be paid by the ECO, not the actual supplier, even though the supplier is different.

Examples of Notified Services under Section 9(5):

| Service Category | GST Liability Falls On |

| Passenger Transport (e.g., Ola, Uber) | ECO |

| Restaurant Services (via apps like Zomato, Swiggy) | ECO |

| Housekeeping Services (when supplied via ECO) | ECO |

➡️ These services have been notified by the government, based on GST Council recommendations.

Notification No. 17/2017 CT (R) dated 28.06.2017/ Notification No. 14/2017 IT (R) dated 28.06.2017

GST on Services Supplied via ECO – Notified Categories (RCM on ECO)

| Sl. No | Type of Service Supplied Through ECO | Is GST Payable by ECO? | Exceptions / Notes |

| (a) | Passenger transport by: radio taxi, motorcab, maxicab, motorcycle, or other motor vehicle (except omnibus) | ✅ Yes – GST payable by ECO | None |

| (b) | Passenger transport by omnibus | ✅ Yes, except when supplier is a company | If the service is supplied by a company, it must pay GST itself |

| (c) | Accommodation services: in hotels, inns, guest houses, clubs, campsites, or other lodging places | ✅ Yes (GST by ECO) | If supplier is registered under Sec. 22(1) it must pay GST itself |

| (d) | Housekeeping services: e.g., plumbing, carpentering, etc. | ✅ Yes (GST by ECO) | If supplier is registered under Sec. 22(1) it must pay GST itself |

| (e) | Restaurant services (delivered through ECOs like Zomato, Swiggy) | ✅ Yes (GST by ECO) | Excludes restaurants at specified premises (accommodation above ₹ 7,500 per unit per day) it must pay GST itself |

Quick Reference – Who Pays GST?

| Service Type | GST Payable By |

| Taxi/Bike/Maxicab via app | ECO ✅ |

| Omnibus (non-company supplier) | ECO ✅ |

| Omnibus (company supplier) | ECO ❌ Supplier ✅ |

| Hotel stays via app (unregistered hotels) | ECO ✅ |

| Hotel stays via app (registered hotels) | ECO ❌ Supplier ✅ |

| Plumber/carpenter via app (unregistered) | ECO ✅ |

| Restaurant via Zomato/Swiggy (normal premises) | ECO ✅ |

| Restaurant via Zomato/Swiggy (5-star hotel) | ECO ❌ Supplier ✅ |

Place of Supply of Goods (Other than Import/Export) – Section 10 of the IGST Act

Section 10(1): Clause-wise Summary

| Clause | Situation | Place of Supply (POS) |

| (a) | Supply involves movement of goods (by supplier, recipient, or any third party) | POS = Where movement terminates for delivery |

| (b) | Bill-to–Ship-to model — goods delivered to one person on direction of another | POS = Principal place of business of the directing person (i.e., Bill-to party) |

| (c) | Supply does NOT involve movement (e.g., ex-warehouse sale) | POS = Location of goods at the time of delivery |

| (ca) NEW | Supply to an unregistered personOverrides (a) and (c) | ✅ If address of delivery of goods is on invoice (even just state) → POS = That address ❌ If no address of delivery of goods is on invoice → POS = Supplier’s location |

| (d) | Goods are assembled or installed at site | POS = Place of installation or assembly |

| (e) | Supply on board a conveyance (e.g., aircraft, train, ship) | POS = Location where goods were taken on board |

| (2) | If none of the above clauses apply | POS = As may be prescribed |

Why (ca) - For instance, migrant workers, tourists, etc. who come to a State for work, tourism, etc. and purchase goods in that State to take it to their respective State. Similarly, in the automobile sector, the residents of a State may travel to another State to purchase vehicle from that State to take advantage of lower registration charges and road tax, which vary from State to State and thereafter, take the vehicle to their State.

Inserted via Finance Act, 2023, effective 1st October 2023.

To address ambiguity in B2C transactions, Clause (ca) overrides Clauses (a) and (c) only for unregistered recipients.

| Invoice Status | Place of Supply |

| Address (even just State name) is recorded | ✅ That address (State) |

| ❌ No address recorded on invoice | ✅ Location of the supplier |

Practical Impact:

Even if goods physically move across States, if the invoice doesn’t show the recipient’s address, the supply is treated as intra-State, and CGST + SGST apply.

Examples on Place of Supply of Goods – Section 10 IGST Act

| Case | Supplier Location | Buyer (Bill-to) | Movement of Goods | Movement Terminates at | Address on Invoice | Clause Applied | Place of Supply (POS) |

| 1 | Gujarat | Maharashtra (Registered) | ✅ Yes | Maharashtra | ✅ Yes | Clause (a) | Maharashtra |

| 2 | Gujarat | Tamil Nadu (Unregistered) | ✅ Yes | Tamil Nadu | ✅ Yes | Clause (ca) (overrides a) | Tamil Nadu |

| 3 | Gujarat | Tamil Nadu (Unregistered) | ✅ Yes | Tamil Nadu | ❌ No | Clause (ca) (overrides a) | Gujarat |

Examples on Place of Supply of Goods – Section 10 IGST Act

| Case | Supplier Location | Buyer (Bill-to) | Movement of Goods | Movement Terminates at | Address on Invoice | Clause Applied | Place of Supply (POS) |

| 4 | Gujarat | Maharashtra (Registered) | ❌ No | Gujarat | ✅ Yes | Clause (c) | Gujarat |

| 5 | Gujarat | Rajasthan (Unregistered) | ❌ No | Gujarat | ✅ Yes | Clause (ca) (overrides c) | Rajasthan |

| 6 | Gujarat | Rajasthan (Unregistered) | ❌ No | Gujarat | ❌ No | Clause (ca) (overrides c) | Gujarat |

Circular No. 209/3/2024 GST dated 26.06.2024

Place of supply of the goods (particularly being supplied through e-commerce platform) to unregistered persons where billing address is different from the address of delivery of goods

Mr. A (unregistered person) located in X State places an order on an e-commerce platform for supply of a mobile phone, which is to be delivered at an address located in Y State. Mr. A, while placing the order on the e-commerce platform, provides the billing address located in X State.

In such a scenario, what would be the place of supply of the said supply of mobile phone, whether the State pertaining to the billing address i.e. State X or the State pertaining to the delivery address i.e. State Y?

ANSWER : As per the provisions of section 10(1)(ca) discussed above, the place of supply of goods shall be the address of delivery of goods recorded on the invoice i.e. State Y in the present case where the delivery address is located.

Clarification on Place of Supply – Advertising Sector (Circular No. 203/15/2023)

Case (i) and (ii):

| Point | Case (i) – | Case (ii) – |

| Grant of Space/Right | Ad Display Service | |

| What’s supplied? | Space or right to use space | Visibility/exposure service |

| Who occupies the space? | Advertising company | Vendor |

| Legal nature | Linked to immovable property | Pure service |

| POS determined by | Section 12(3)(a) | Section 12(2) |

| POS result | Where the hoarding is located | - If recipient is registered ➝ Location of recipient - If recipient is unregistered ➝ Location of recipient as per invoice, otherwise location of supplier |

Affiliation Services

Affiliation refers to the process by which an educational board, council, or university evaluates whether a school or college meets certain standards (infrastructure, faculty, finances, etc.) to operate under its banner and offer recognized courses or programs.

Clarified that affiliation is not related to admission or exams

| Provider | Recipient | Type | GST? | Circular/Entry |

| University | College | Affiliation | ✅ Taxable | Circular No. 234/28/2024 |

| Board/Council | Govt School | Affiliation | ❌ Exempt | Entry 66A |

| Board/Council | Private School | Affiliation | ✅ Taxable | Circular No. 234/28/2024 |

Gov School includes - Central Government, State Government, Union Territory, local authority

Exempt from GST:

|

Service Type |

Provided By |

GST Applicability |

|

(a) Sale of platform tickets |

Ministry of Railways (Indian Railways) |

❌ Exempt |

|

(b) Facility of retiring rooms/waiting rooms |

Ministry of Railways |

❌ Exempt |

|

(c) Cloak room services |

Ministry of Railways |

❌ Exempt |

|

(d) Battery operated car services |

Ministry of Railways |

❌ Exempt |

|

Nature of Service |

From |

To |

GST? |

|

Internal services (repairs, admin, logistics, etc.) |

One zone/division under Ministry of Railways |

Another zone/division under same Ministry |

❌ Exempt |

|

Provided by |

To Whom |

GST Applicability |

|

Air Force Mess and other similar messes, such as, Army mess, Navy mess, Paramilitary and Police forces mess |

their personnel or any person other than a business entity |

❌ Exempt under Entry 6 |

To business entity |

✅ Taxable |

Some businesses hire non-air-conditioned buses or vans to transport employees to and from work. The question is whether such services are exempt under GST.

|

Type of Hiring |

Exempt under GST? |

GST Treatment |

|

Fixed route + schedule, no free disposal (e.g., employee shuttle) |

✅ Yes |

Exempt |

|

Vehicle hired for full day, under company’s control |

❌ No |

Taxable |

|

Scenario |

GST Applicability |

|

Company books a fixed employee shuttle from home to office at 9 AM and return at 6 PM (non-A/C) |

❌ Exempt |

|

Company hires a bus 8 AM–8 PM daily, to use however they wish (meetings, pickups, etc.) |

✅ Taxable |

Goods Transport Agencies (GTAs) often perform additional services along with transport, such as:

The question is: Are these services separately taxable, or are they part of the GTA service?

Ancillary or incidental services provided in the course of transportation of goods by road by a GTA shall be treated as part of a composite supply

➡️ Tax treatment = as applicable to transportation of goods (principal supply)

As long as services are part of the same transport contract, they are considered composite supply.

If services like loading/unloading, warehousing, or packing are:

✅ Exempt Services (When Provided to a Governmental Authority):

|

Sr. No. |

Type of Service |

|

(a) |

Water supply |

|

(b) |

Public health |

|

(c) |

Sanitation conservancy |

|

(d) |

Solid waste management |

|

(e) |

Slum improvement and upgradation |

Renting of residential dwelling for use as residence is exempt from GST when provided:

Explanation 1

Explanation 2

|

Situation |

GST Treatment |

|

Residential dwelling is rented to a registered person (not covered under Explanation 1) |

✅ Taxable under RCM |

|

Residential dwelling is used for commercial purposes |

✅ Taxable |

|

Residential dwelling is rented to a registered person who is proprietor of a proprietorship concern, rented in his personal capacity for residence of employees |

✅ Taxable |

|

Accommodation in hostels, PGs, camps, student residences |

✅ Taxable – excluded under Explanation 2 |

✅ Exempt When All 3 Conditions Are Met:

✔️ This is mainly for long-term affordable stays like for working professionals or students

What is the HAM Model? (Hybrid Annuity Mode)

Under HAM:

➡️ This model falls under Design, Build, Operate, and Transfer (DBOT) framework.

The entire project is to be treated as a single continuous supply of service under Section 2(33) of the CGST Act, 2017

Time of Supply (ToS) Rules Applicable in HAM Contracts

As it's a continuous supply of service, Section 13(2)/13(5) of CGST Act applies.

|

Situation |

When is Tax Liability Triggered? |

|

? Invoice is issued on or before specified date/event |

✅ Earlier of: Invoice date OR payment receipt date |

|

❌ Invoice not issued on/before specified date/event |

✅ Earlier of: Date of service provision (event due) OR payment receipt date |

Interest Component in Annuity Installments

If annuity installments paid by NHAI include an interest component, That interest must be included in the taxable value, as per Section 15(2)(d) of the CGST Act.

5 Cut-off date for availing ITC on any invoice or debit note is:

|

Criteria |

|

A. 30th November of the following financial year |

|

B. Date of filing the annual return for that financial year |

✅ You can take ITC only up to the earlier of these two dates.

Section 16(4) + RCM from Unregistered Suppliers – Time Limit Clarified - Circular No. 211/5/2024

When you receive supplies from unregistered persons, and you’re liable to pay GST under Reverse Charge Mechanism (RCM):

|

Event |

Date |

|

Unregistered supplier delivers goods |

10 March 2024 |

|

Recipient issues self-invoice (u/s 31(3)(f)) |

5 April 2024 |

|

Tax paid by recipient under RCM |

5 April 2024 |

you cannot file returns for that period.

Example for Absolute Clarity:

|

Event |

Date |

|

Invoice Date |

1 Jan 2024 (FY 2023–24) |

|

16(4) ITC deadline |

30 Nov 2024 |

|

Registration Cancelled |

1 Oct 2024 |

|

Registration Revoked |

15 Jan 2025 |

So your 16(4) limit was 30 Nov 2024 … but you were not eligible to fill up return and claim ITC as your registration was cancelled on 1st Oct 2024, hence as per 16(6) is the registration is revoked on 15th Jan 2025 so you can file a return within next 30 days and claim the ITC even after the 16(4) deadline.

Section 17(5)(a) of the CGST Act blocks ITC on motor vehicles for transportation of persons with ≤13 persons (including driver), except in certain specified cases.

One of the key exceptions [sub-clause (A)] is:

ITC is allowed if the motor vehicle is used for making further supply of such motor vehicles (i.e., resale). Hence Dealers of cars could get ITC on the cars they sold.

What Was the Confusion?

Dealers purchase demo vehicles to:

But they don't sell the demo car itself immediately.

So, the question arose:

❓ Are demo vehicles considered to be used “for further supply of such motor vehicles”?

✅ Clarification by CBIC:

✔️ Yes — demo vehicles are used for further supply, indirectly promoting sale of the same kind of vehicles.

Therefore:

✅ ITC on demo vehicles is NOT blocked under Section 17(5)(a)

✅ ITC is NOT restricted on ducts and manholes used in Optical Fiber Cable Networks

✅ Why ITC is Allowed:

E-Invoicing Applicability to Government Departments Registered for TDS (Section 51) - Circular No. 198/10/2023

Is a supplier (who crosses the e-invoicing turnover threshold) required to generate e-invoices when making supplies to:

Supplies made to such Government entities (registered only for TDS purposes)

➡️ Must be e-invoiced by suppliers exceeding the e-invoicing turnover threshold, as these entities qualify as registered persons under GST.

|

Ledger |

Can be used to pay |

Cannot be used to pay |

|

Electronic Credit Ledger (ITC) |

✅ Output tax (from returns or demand orders) |

❌ RCM tax, ❌ Interest, ❌ Penalty, ❌ Fee, ❌ Refund recovery |

|

Electronic Cash Ledger |

✅ All GST liabilities – Tax, RCM, Interest, Penalty, Fees, Refund demands, etc. |

Fully Flexible can be used as needed |

If IGST credit is wrongly availed and later reversed should we only check the balance in IGST ledger, or should we also consider CGST + SGST balances?

✅ CBIC Clarification:

Since IGST liability can be paid using ITC from IGST, CGST, or SGST,

➡️ You must consider the total ITC available in the Electronic Credit Ledger (ECL) — across IGST + CGST + SGST — combined, not just IGST head.

Example:

|

Event |

Value |

|

Wrongly availed IGST ITC |

₹1,00,000 |

|

Combined ITC balance during the period (IGST + CGST + SGST) |

Always ≥ ₹1,00,000 |

➡️ ✅ No interest payable |

But if combined ITC balance dropped to ₹70,000 for any day before reversal:

➡️ ✅ Interest applies on ₹30,000 for that period (i.e., the utilized portion)

TDS Under GST (Section 51)

There are 4 categories of such people/entities:

|

Clause |

Who? |

|

(a) |

C / S Government departments |

|

(b) |

Local authorities |

|

(c) |

Government agencies |

|

(d) |

Special people notified by the govt (explained below) ✅ |

Any registered person who buys metal scrap falling under Chapters 72 to 81 in the First Schedule to the Customs Tariff Act, 1975 from another registered person

➡️ If you buy scrap, you have to deduct TDS now

❌ When TDS is NOT Required (Exemptions):

|

Sl. No. |

Invoice-wise details of ALL |

Consolidated details of ALL |

Debit and credit notes |

|

(i) |

Inter-State and Intra-State supplies made to registered persons, i.e. B2B supplies. |

Intra-State supplies made to unregistered persons for each rate of tax |

Issued during the month for invoices issued previously |

|

(ii) |

Inter-State supplies made to unregistered persons with invoice value exceeding ₹1,00,000, i.e. B2C supplies |

Inter-State supplies made to unregistered persons with invoice value upto ₹1,00,000 for each rate of tax separately for each State |

Ruchika Ma'am has been a meritorious student throughout her student life. She is one of those who did not study from exam point of view or out of fear but because of the fact that she JUST LOVED STUDYING. When she says - love what you study, it has a deeper meaning.

She believes - "When you study, you get wise, you obtain knowledge. A knowledge that helps you in real life, in solving problems, finding opportunities. Implement what you study". She has a huge affinity for the Law Subject in particular and always encourages student to - "STUDY FROM THE BARE ACT, MAKE YOUR OWN INTERPRETATIONS". A rare practice that you will find in her video lectures as well.

She specializes in theory subjects - Law and Auditing.

Yash Sir (As students call him fondly) is not a teacher per se. He is a story teller who specializes in simplifying things, connecting the dots and building a story behind everything he teaches. A firm believer of Real Teaching, according to him - "Real Teaching is not teaching standard methods but giving the power to students to develop his own methods".

He cleared his CA Finals in May 2011 and has been into teaching since. He started teaching CA, CS, 11th, 12th, B.Com, M.Com students in an offline mode until 2016 when Konceptca was launched. One of the pioneers in Online Education, he believes in providing a learning experience which is NEAT, SMOOTH and AFFORDABLE.

He specializes in practical subjects – Accounting, Costing, Taxation, Financial Management. With over 12 years of teaching experience (Online as well as Offline), he SURELY KNOWS IT ALL.