CA Foundation Accounts Paper Jan 2025 with Answers

Looking for solutions to the CA Foundation Accounts Paper January 2025? You’re in the right place! This blog covers everything you need to know about the CA Foundation January 2025 Exam, including detailed solutions and insights to help you excel. We’re here to provide a comprehensive breakdown of the January 2025 Accounts Paper

Table of Contents

CA Foundation Jan 25 Suggested Answer Other Subjects Blogs :

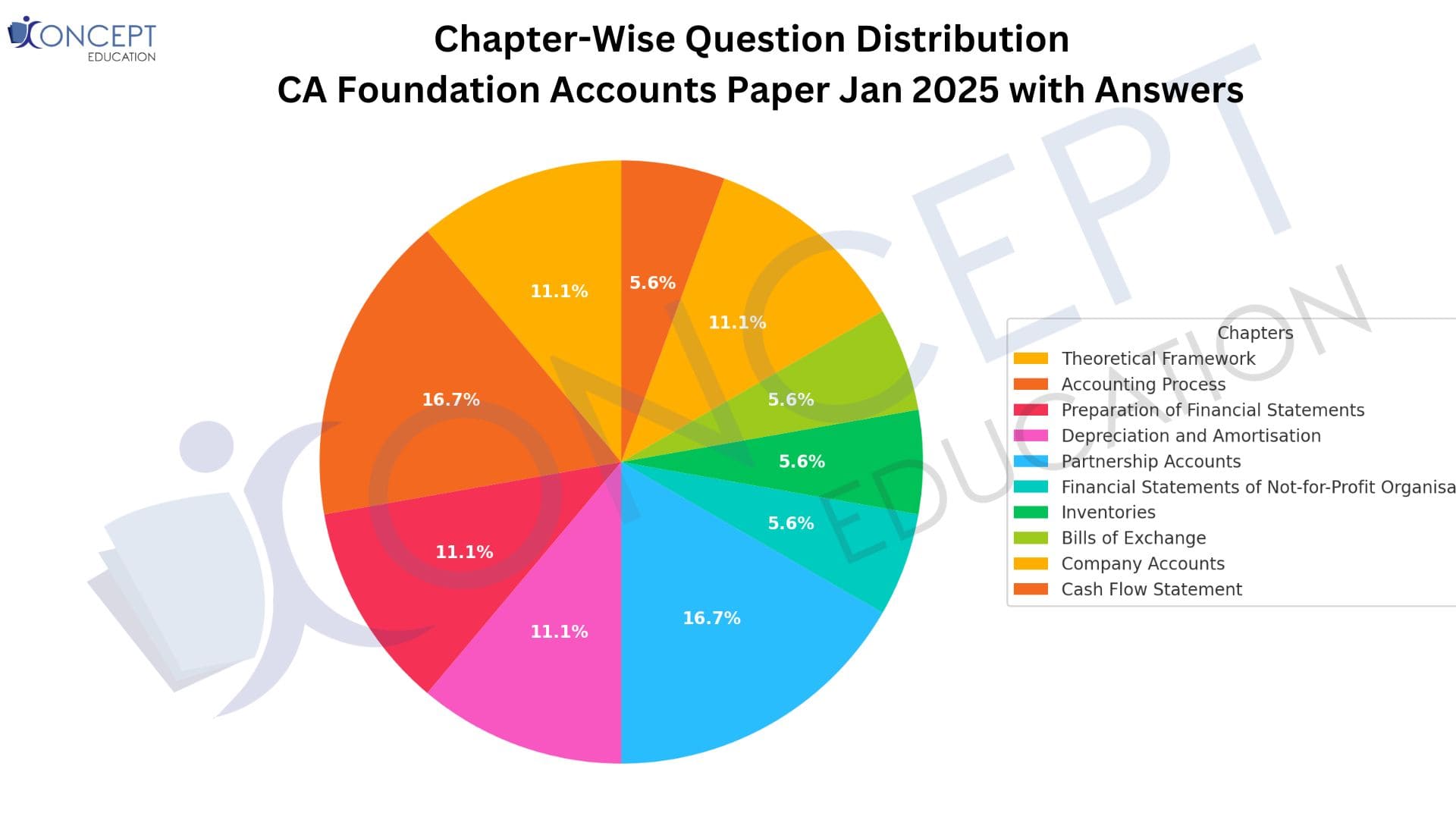

CA Foundation Jan 25 Paper Analysis

The January 2025 Accounts paper maintained a balanced mix of theory and practical questions. Around 30% of the paper was easy, focusing on basic concepts and straightforward numerical problems, which could be quickly attempted. 50% of the paper was of medium difficulty, requiring solid conceptual understanding and multi-step adjustments. The remaining 20% was challenging, particularly in areas like partnership revaluation and machinery account adjustments under multiple depreciation methods. Upcoming students should focus on advanced adjustments, partnership accounting, and practice in-depth final accounts and BRS problems to maximize performance. Time management and conceptual clarity will be key to scoring well.

Question 1 (A) : State with reasons, whether the following statements are True or False :

(i) Matching concept is based on accrual concept (ICAI Book Page 1.39)

TRUE : This concept is based on accrual concept as it considers the occurrence of expenses and income and do not concentrate on actual inflow or outflow of cash. This leads to adjustment of certain items like prepaid and outstanding expenses, unearned or accrued incomes.

(ii) Customers of business should not be considered as users of accounts prepared by business. They are not interested in knowing the performance of the business. (ICAI Book Page 1.26 Que 4)

FALSE : Customers are also concerned with the stability and profitability of the enterprise because their functioning is more or less dependent on the supply of goods.

(iii) Under inflationary conditions, FIFO will not show lowest values of cost of goods sold. (ICAI Book Page 4.25 Que 15)

FALSE : Under inflationary conditions, LIFO and weighted average will not show lowest value of cost of goods sold.

(iv) For redemption of preference shares, proceeds from fresh issue of equity shares and debentures can be utilized. (ICAI Book Page 11.155)

FALSE : A company can issue new shares (equity shares or preference shares) and the proceeds from such new shares can be used for redemption of preference shares, but the proceeds from issue of debentures cannot be utilised for the redemption of preference shares. Thus the statement is false.

(v) Book keeping and accounting are not synonymous terms; they are different from each other. (ICAI Book Page 1.26 Que 1)

TRUE : Book-keeping and accounting are different from each other. Accounting is a broad subject. It calls for a greater understanding of records obtained from book keeping and an ability to analyse and interpret the information provided by book keeping records. Book keeping is the recording phase while accounting is concerned with the summarising phase of an accounting system.

(vi) A ledger is also known as the principal books of accounts. (ICAI Book Page 2.60 Que 1)

TRUE : Since it classifies all the amounts related to a particular account and then it is used as the base for preparing the Trial balance, a ledger is also known as principal books of accounts.

Question 1 (B) : Explain four main functions of Accounting.

Answer:- Four Main Functions of Accounting

Question 1 (C) : From the following transactions, prepare the Sales Return Book of Kay & Co., a readymade garments dealer:

| Date | Particulars |

|---|---|

| 06/12/2024 | Return received from Aar Store 30 shirts @ ₹ 300/- and 15 trousers @ ₹ 500/- each | Less: Trade Discount @ 8% |

| 12/12/2024 | Modern Tailors returned 10 frocks (which were sold for cash) @ ₹ 200/- each |

| 16/12/2024 | Return received from Tulip Store - 12 T-shirts @ ₹ 100/- each | Less: Trade Discount @ 10% |

Answer:-

Sales Return Book of Kay & Co. for December 2024

| Date | Particulars | Details | L.F. | Amount (₹) |

|---|---|---|---|---|

|

06/12/2024

|

Aar Store 30 Shirts @ ₹ 300 = ₹ 9,000 15 Trousers @ ₹ 500 = ₹ 7,500 Less: Trade Discount @ 8% |

₹ 16,500 ₹ (1,320) |

₹ 15,180 |

|

|

16/12/2024

|

Tulip Store 12 T-shirts @ ₹ 100 Less: Trade Discount @ 10% |

₹ 1,200 ₹ (120) |

₹ 1,080 |

|

| Total | ₹ 16,260 | |||

Question 2 (A) :

A firm purchased a second-hand machinery on April 1, 2021 for ₹ 15,00,000 subsequent to which ₹ 2,00,000 were spent on its repairs and installation. On October 1, 2021, another machinery was purchased for ₹ 9,00,000 and the cost of installing the machine in a new plant is ₹ 20,000. The firm also shifted the machinery purchased on April 1, 2021 to the new plant and incurred freight of ₹ 10,000. They adopted a policy of charging depreciation @ 12% per annum on the diminishing balance method.

On April 1, 2023, it was decided to change the method and rate of depreciation to the straight-line basis. On this date, the remaining useful life was assessed as 5 years for both the machines purchased with no scrap value.

On October 1, 2023, the first machine became outdated and sold for ₹ 2,50,000. On the same date, another machinery was purchased for ₹ 8,50,000. The estimated useful life of the machine is 10 years and residual value is ₹ 30,000.

You are required to prepare the machinery account for the year ending March 31, 2024.

Answer:-

Question 2 (B) :

From the following information, prepare a Bank Reconciliation Statement as on June 30, 2024, for M/s XYZ Limited:

(i) The Bank column of Cash Book was overdrawn to the extent of ₹ 24,768.

(ii) Bank charges amounting to ₹ 350 had not been entered in the Cash Book.

(iii) Cheque amounting to ₹ 88,678 issued before June 30, 2024, but not yet presented to Bank.

(iv) One payment of ₹ 4,590 was recorded in the Cash Book as if there is no bank column.

(v) The company paid ₹ 15,500 to a creditor and received a cash discount @ 2%. The cashier erroneously entered the gross amount in the bank column of the Cash Book.

(vi) A debit of ₹ 5,700 appeared in the Bank Statement for an unpaid cheque, which had been returned marked 'out of date.' The cheque had been re-dated by the customer and paid into the Bank again on July 8, 2024.

(vii) Cheques deposited in bank but not yet cleared amount to ₹ 45,789.

(viii) Dividends of ₹ 1,980 collected by the Bank was not recorded in the Cash Book.

(ix) Amount of ₹ 2,340 wrongly credited by bank to company account for which no details are available.

(x) On June 25, 2024, the credit side of bank column of the Cash Book was overcast by ₹ 6,789.

Answer:-

Question 3 (A) :

From the following schedule of balances extracted from the books of Mr. Piyush, prepare Trading and Profit and Loss Account for the year ended 31st March, 2024 and the Balance Sheet as on that date after making the necessary adjustments:

| Particulars | Dr. (₹) | Cr. (₹) |

| Capital Account | 8,85,000 | |

| Stock on 1.4.2023 | 3,86,000 | |

| Cash in hand | 18,500 | |

| Cash at Bank | 73,500 | |

| Investments (at 9%) as on 1.4.2023 | 50,000 | |

| Deposits (at 10%) as on 1.4.2023 | 3,00,000 | |

| Drawings | 78,000 | |

| Purchases | 24,95,000 | |

| Sales | 29,86,000 | |

| Return Inwards | 1,10,000 | |

| Return Outwards | 1,38,000 | |

| Carriage inwards | 1,26,000 | |

| Rent | 66,000 | |

| Salaries | 1,15,000 | |

| Sundry Debtors | 2,35,000 | |

| Sundry Creditors | 1,37,500 | |

| Bank Loan (at 12%) as on 1.10.2023 | 2,00,000 | |

| Furniture as on 1.4.2023 | 25,000 | |

| Interest paid | 12,500 | |

| Interest received | 28,500 | |

| Advertisement | 40,300 | |

| Printing & Stationery | 32,200 | |

| Electricity Charges | 57,700 | |

| Discount allowed | 55,200 | |

| Discount received | 24,600 | |

| Bad debts | 18,500 | |

| General expenses | 36,800 | |

| Motor Car Expenses | 8,500 | |

| Insurance Premium | 30,000 | |

| Travelling Expenses | 21,800 | |

| Postage & Courier | 8,100 | |

| Total | 43,99,600 | 43,99,600 |

Adjustments:

(i) The value of stock as on 31st March, 2024 is ₹ 7,65,000. This includes goods returned by customers on 31st March, 2024 to the value of ₹ 25,000 for which no entry has been passed in the books.

(ii) Purchases include one furniture item purchased on 1st January, 2024 for ₹ 10,000. Depreciation @ 10% p.a. is to be provided on furniture.

(iii) One month's rent is outstanding and ₹ 12,000 is payable towards salary.

(iv) Interest paid includes ₹ 9,000 paid against Bank Loan and Interest received pertains to Investments and Deposits.

(v) Provide for interest payable on Bank Loan and interest receivable on investments and deposits.

(vi) Make provision for doubtful debts at 5% on the balance under sundry debtors.

(vii) Insurance premium includes ₹ 18,000 paid towards proprietor’s life insurance policy.

Answer:-

Question 3 (B) :

X and Y are partners sharing profits and losses in the ratio of their effective capital. As on 1st April, 2023, they had ₹ 2,80,000 and ₹ 1,60,000 respectively in their Capital Accounts.

X introduced a further capital of ₹ 20,000 on 1st June, 2023 and another ₹ 15,000 on 1st October, 2023. On 31st January 2024, X withdrew ₹ 25,000.

On 1st August, 2023 Y introduced further capital of ₹ 30,000.

During the Financial year 2023-24, the partners drew the following amounts in anticipation of profit:

X drew ₹ 5,000 at the beginning of each quarter and Y drew ₹ 1,500 per month at the end of each month beginning from April, 2023.

As per partnership agreement, the profits were to be shared in capital ratio. The interest on Capital @ 12% p.a. is allowable and interest on drawings @ 10% p.a. is chargeable.

You are required to calculate:

(i) Profit-sharing ratio;

(ii) Interest on capital; and

(iii) Interest on drawings.

Answer:-

Question 4 (A) :

A, B, and C are partners sharing profits & losses in the ratio of 3:2:1.

The following is the Balance Sheet of their firm M/s ABC Trading Corporation as on 31st March, 2024:

Balance Sheet as on 31st March, 2024

| Liabilities | Amount (₹) | Assets | Amount (₹) |

| Capital Accounts: | Land & Building | 2,40,000 | |

| A | 2,80,000 | Machinery | 1,50,000 |

| B | 1,90,000 | Furniture & Fixtures | 1,05,000 |

| C | 1,50,000 | Trade Receivables 1,55,200 | |

| General Reserve | 1,35,000 | Less: Provision for Doubtful Debts 5,700 | |

| Trade Payables | 97,400 | 1,49,500 | |

| Stock | 85,600 | ||

| Joint Life Policy | 90,000 | ||

| Cash & Bank | 32,300 | ||

| Total | 8,52,400 | Total | 8,52,400 |

i. Goodwill of firm was to be valued at 2 years’ purchase of average profit of four years to 31st March preceding the death of partner. The profits were as under:

31st March, 2021: ₹ 1,14,000

31st March, 2022: ₹ 1,22,000

31st March, 2023: ₹ 1,19,000

31st March, 2024: ₹ 1,25,000

Goodwill Account will not be opened in the books of accounts and C was to be credited with his share. The new profit-sharing ratio of A and B will be 5:3.

ii. Profit till the date of death to be ascertained on the basis of average profit of previous four years and share of C was to be credited to his capital account.

iii. Assets were to be revalued: Land & Building was appreciated by 15%, Machinery to be depreciated by 5%, Furniture & Fixtures to be revalued at ₹ 1,00,000 and the value of Stock to be taken at ₹ 90,000.

iv. Provision for doubtful debts to be increased by ₹ 1,800.

v. A sum of ₹ 2,40,000 was received from insurance company against Joint Life Policy.

vi. Amount due to C was paid to the executors.

You are required to prepare Revaluation Account, Partners Capital Accounts and Balance Sheet as on 30th June, 2024, along with necessary workings.

Answer:-

Question 4 (B) :

Following are the details of Assets and Liabilities of Mr. Sarthak for the year ended 31st March, 2023 and 31st March, 2024:

| 31st March, 2023 (₹) | 31st March, 2024 (₹) | |

| Assets: | ||

| Building | 2,00,000 | ? |

| Furniture | 75,000 | ? |

| Inventory | 1,05,000 | 1,95,000 |

| Sundry Debtors | 68,000 | 94,000 |

| Cash at Bank | 72,500 | 86,800 |

| Cash in hand | 2,400 | 3,800 |

| Liabilities: | ||

| Loans | 1,50,000 | 1,25,000 |

| Sundry Creditors | 58,400 | 79,500 |

It was decided to depreciate Building by 5% p.a. and Furniture by 10% p.a. On 1st June, 2023 an additional capital of ₹ 40,000 was brought in the business. Proprietor has withdrawn @ ₹ 2,500 p.m. for meeting the family expenses.

Prepare Statement of Affairs as on 31st March, 2023 and 31st March, 2024. Find the profit or loss earned by Mr. Sarthak for the year ended 31st March, 2024.

Answer:-

Question 5 (A) :

From the following income and expenditure account of a Club for the year ending 31st March, 2024, you are required to prepare receipt and payment account for the year ending 31st March, 2024 and Balance Sheet as on 1st April, 2023.

INCOME AND EXPENDITURE ACCOUNT

For the year ending 31st March, 2024

| Expenditure | Amount (₹) | Income | Amount (₹) |

| To Lawn Maintenance | 42,000 | By Subscription | 1,05,000 |

| To General Expenses | 13,000 | By Admission Fees | 12,000 |

| To Stationery (Depreciation) | 1,500 | By Sports Material (Sale of second-hand material) | 2,400 |

| To Depreciation on Sports Material | 22,000 | By Entertainment | 14,000 |

| To Honorarium | 10,400 | ||

| To Excess of Income over Expenditure | 44,500 | ||

| Total | 1,33,400 | Total | 1,33,400 |

Additional Information:

| Particulars | 1st April, 2023 | 31st March, 2024 |

| Cash at Bank | 60,000 | — |

| Stock of Sports Material | 30,000 | — |

| Tournament Fund (after deducting tournament expenses of ₹ 14,000) | 6,000 | |

| Donations for Club Building | 1,40,000 | |

| Subscription Due | 10,000 | 15,000 |

| Stationery Stock | 4,000 | — |

Stationery was depreciated by 25% and Sports material by 50%.

Answer:-

Question 5 (B) :

Attempt any ONE of the two sub-parts i.e., either (i) or (ii):

(i) Mr. A accepts two bills of exchange on June 1, 2024 for ₹ 1,50,000 and ₹ 60,000 drawn on him by Mr. B. The bill of exchange for ₹ 1,50,000 is for two months while the bill of exchange for ₹ 60,000 is for three months. Mr. B got the first bill discounted with the bank for ₹ 1,49,000 on June 3, 2024. On August 2, 2024 Mr. A requested Mr. B to cancel both the bills and drew a new bill on him with the combined amount of both the bills along with interest @ 12% per annum for a period of two months. Before the due date of the renewed bill on September 3, 2024, Mr. A becomes insolvent and only 40 paise in a rupee could be recovered from his estate.

You are required to give the journal entries in the books of Mr. B.

Answer:-

OR

Question 5 (B) :

The Following details are available of raw material of a manufacturing unit:

|

Date |

Particulars |

Details |

|

1-5-2024 |

Opening Inventory |

100 units @ ₹ 15 per unit |

|

2-5-2024 |

Purchases |

300 units @ ₹ 18 per unit |

|

5-5-2024 |

Issued for consumption |

250 units |

|

16-5-2024 |

Purchases |

500 units @ ₹ 21 per unit |

|

21-5-2024 |

Issued for consumption |

100 units |

|

25-5-2024 |

Issued for consumption |

450 units |

The manufacturer also incurred the following expenses:

You are required to find out the value of inventory as on May 31, 2024 if the company follows:

(a) Weighted Average method for inventory valuation.

(b) First in First Out method for inventory valuation.

Answer:-

Question 5 (C) :

A company had issued 20,000, 8% partly convertible debentures of ₹ 100 each on April 1, 2023. The debentures are due for redemption on June 1, 2024. The terms of the issue of debentures provided that 30% of the debentures will be converted into equity shares (Nominal Value ₹ 10) at a price of ₹ 20 per share and remaining will be redeemable at a premium of 5%.

(i) Calculate the number of equity shares to be allotted to the debenture holders at the time of conversion.

(ii) Give the necessary journal entries related to the conversion and redemption of debentures assuming that the company has created the Debenture Redemption Reserve and also invested required amount for redemption of debentures at the time of issue. Debenture Redemption Reserve Investment are sold at par value.

Answer:-

Question 6 (A) :

Arpit Ltd., with an authorized capital of ₹ 20,00,000 divided into Equity shares of ₹ 10 each, on 1st June, 2023, invited applications for issuing 3,00,000 Equity shares at a premium of ₹ 5 per share. The amount was payable as follows:

All the shares were applied for and allotted. Mr. Naresh who held 20,000 shares paid the whole of the amount due on calls along with allotment money. The final call was fully paid except a shareholder having 5,000 shares who paid his due amount on 1st March, 2024 i.e., after 2 months along with interest on calls in arrears @ 10% p.a. The Company also paid interest @ 12% p.a. on calls in advance to Mr. Naresh on 1st Jan., 2024.

Give journal entries with narrations to record all these transactions in the books of Arpit Ltd.

Answer:-

Question Q 6 (B) :

What are the advantages of Double Entry System?

Answer:-

Ruchika Ma'am has been a meritorious student throughout her student life. She is one of those who did not study from exam point of view or out of fear but because of the fact that she JUST LOVED STUDYING. When she says - love what you study, it has a deeper meaning.

She believes - "When you study, you get wise, you obtain knowledge. A knowledge that helps you in real life, in solving problems, finding opportunities. Implement what you study". She has a huge affinity for the Law Subject in particular and always encourages student to - "STUDY FROM THE BARE ACT, MAKE YOUR OWN INTERPRETATIONS". A rare practice that you will find in her video lectures as well.

She specializes in theory subjects - Law and Auditing.

Yash Sir (As students call him fondly) is not a teacher per se. He is a story teller who specializes in simplifying things, connecting the dots and building a story behind everything he teaches. A firm believer of Real Teaching, according to him - "Real Teaching is not teaching standard methods but giving the power to students to develop his own methods".

He cleared his CA Finals in May 2011 and has been into teaching since. He started teaching CA, CS, 11th, 12th, B.Com, M.Com students in an offline mode until 2016 when Konceptca was launched. One of the pioneers in Online Education, he believes in providing a learning experience which is NEAT, SMOOTH and AFFORDABLE.

He specializes in practical subjects – Accounting, Costing, Taxation, Financial Management. With over 12 years of teaching experience (Online as well as Offline), he SURELY KNOWS IT ALL.